You may contact Speedpay directly by dialing 1-888-849-4310. Optimize cash flow and earn card rewards by paying National Grid with your credit card.

Frequently Asked Questions National Grid

Frequently Asked Questions National Grid

We make it easy to pay your bill online or otherwise.

National grid credit card payment. Determining client scripting support. Pay all major credit cards load money onto bank debit or prepaid cards and pay retail or store cards. 225 for residential customers 600 limit per transaction.

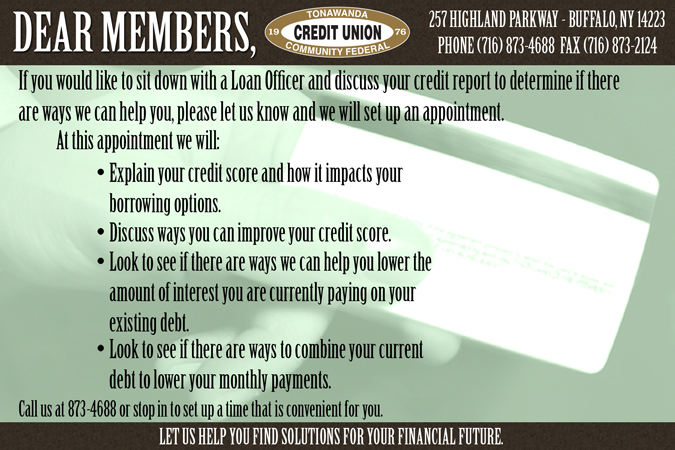

Whether you need help with paying bills lowering them or are interested in a free virtual credit card this app is a great choice. On the bill due date. The full amount owed.

The current bill and any outstanding fees. DoNotPay can also help you get robocall revenge against National Grid scams. Make checks payable to National Grid and use the envelope provided with your bill or mail to.

Here you can pay your National Fuel bill quickly and easily online. National Grid for some reason will only accept a credit card payment from customers through Western Union who charges 225 to do so. Its easy to manage your National Grid accounts view bills and make payments online.

Literally National Grid is making customers pay someone for the pleasure of paying their monthly utility bill. Once every billing period. Please note that you will be charged convenience fees by Speedpay.

The convenience fee to use this service is 225 for residential customers paying bills up to 600 and 795 for non-residential customers paying bills up to 1000. National Grid accepts all major credit card and debit card payments through Speedpay. The service carries a 225 fee for residential customers since the service is handled through.

The amount due is automatically withdrawn on the bill due date. You can pay your bills at a walk-in payment center or at an authorized agency by credit card check or cash. National Grid is now allowing customers to pay their monthly bills with debit and credit cards.

Pay by bank account optionally on an automated basis creditdebit card phone mail and at designated locations. Please note that there is a 295. Welcome to the Payment Center for National Fuel.

National Grid receives no compensation for this payment service. Register here to get started. National Grid Adds Credit And Debit Card Payment Options For Customers In Brooklyn Staten Island And Queens November 16 2009 As an added convenience for its customers in Brooklyn Staten Island and Queens National Grid is now accepting credit and debit card payment via the phone and internet through Western Union Speedpay.

Utility company National Grid is now accepting debit and credit card payments online and over the phone. For identification purposes you need to have ready your most recent National Fuel bill and your debit card or credit card information. You receive a call from a scammer demanding payment.

All done simply and securely. Many posting options available including immediate same-day. 3 Submit a payment.

Direct Payment is the easiest way to pay your bill. The payments however are handled by third-party financial institution Western Union which assesses a fee for each transaction. Welcome to Box for National Grid.

Authorized agencies are located throughout National Grids service area - check on National Grids website to find the closest payment center near you. Box 11739 Newark NJ 07101-4739. 1 Enter your email.

This is not a free service and you are acknowledging the Box license fee will be charged to National Grid. Western Union Speedpay is a bill payment site that handles billing services for outside companies. The plan ends only when you cancel.

Heres how you can fight back against robocalls with DoNotPay. 2 Create an account. Over 300 companies available for bill pay including Con Edison NYC Housing Rent NYCHA Optimum National Grid Verizon Spectrum and many more.

/credit-card--concept-credit-card-payment-1156857742-c265746dcaea46e6bcc5f0bcda1ed871.jpg)