Since a reverse mortgage is a loan and the borrower is not making payments on a monthly basis to pay back that loan interest continues to accrue which INCREASES the balance of the loan. By borrowing against an asset in this case a home itll generate cash flow to settle other debts or help pay for medical bills.

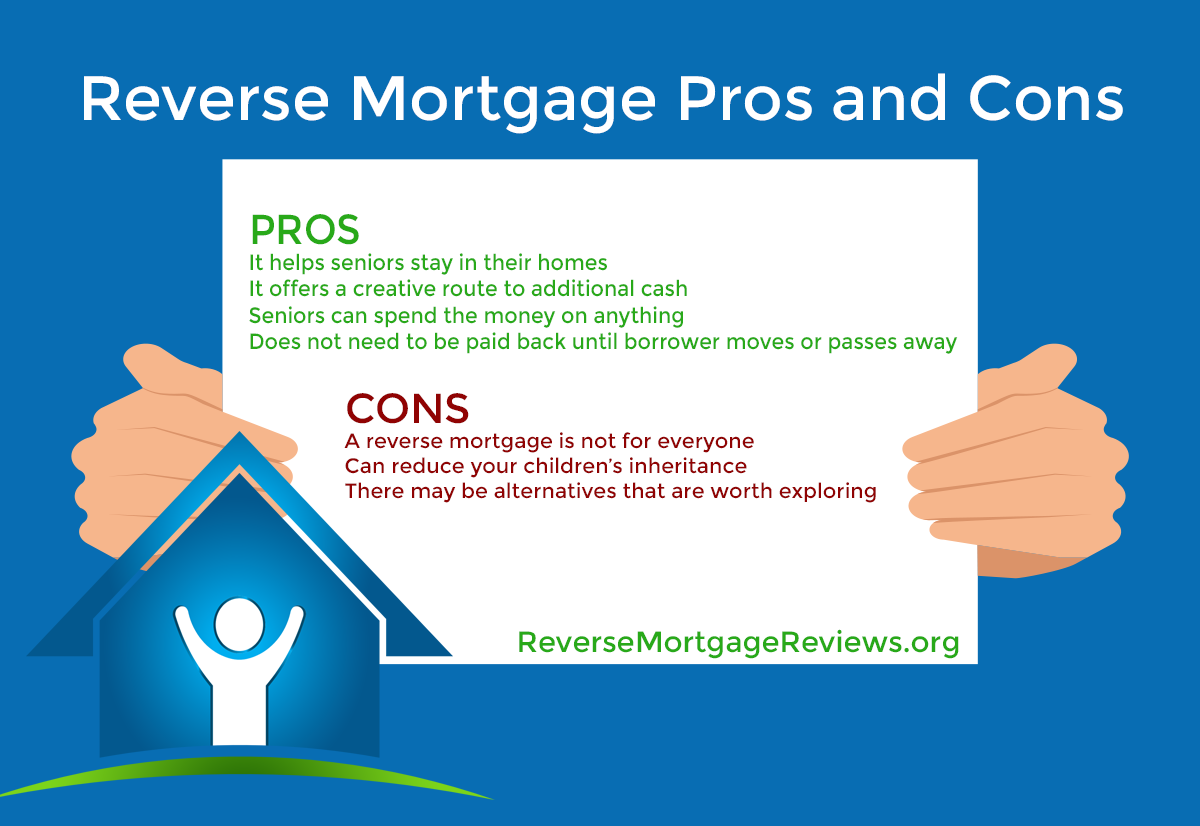

Reverse Mortgages Come With Upsides Downsides Reversemortgagereviews Org

Reverse Mortgages Come With Upsides Downsides Reversemortgagereviews Org

You can choose to receive the money as a lump sum annuity line of credit or a combination of all three.

Reverse mortgage pros cons. Pros of Reverse Mortgages. A reverse mortgage is a mortgage loan usually secured by a residential property that lets you convert a portion of the equity in your property into cash. With the government insured reverse mortgage HUD HECM borrowers have both 2 upfront and 50 annual renewal mortgage insurance premiums MIP to pay.

You can have access to a large amount of cash or a steady source of income in your retirement even if you already have an existing mortgage. The Reverse Mortgage Pros and Cons in 2021 April 20 2021 By Admin no comments Theres no doubt that the decision to get a reverse mortgage can be a big one especially depending on the borrowers particular financial situation. They are a steady stream of income that lasts for years.

Reverse mortgages can have higher closing costs vs traditional mortgages. A reverse mortgage may be helpful but isnt for everyone. The money is tax free.

Pros and Cons of Reverse Mortgages. Reverse Mortgage Cons The ability to tap into your homes equity can help pay for retirement but there are some negatives. Rather than income earned a reverse mortgage is considered a.

This is probably the biggest con. CONS of a Reverse Mortgage The loan balance increases over time as interest on the loan and fees accumulate. While there are numerous benefits to this financial product there are some drawbacks you must be aware of.

Heirs are not personally liable if payoff balance exceeds home value. A reverse mortgage seems a good idea to ensure a financially secure retirement and positively enhance the quality of life. Eliminate any existing mortgage.

Reverse Mortgage Pros And Cons. There are a few factors that can make a reverse mortgage worth it. Cons of reverse mortgages You could default and potentially lose your home if you dont meet certain requirements With a reverse mortgage you default when you fail to meet.

With a Reverse Mortgage you will never owe more than your homes value at the time the loan is repaid even if the Reverse Mortgage lenders have paid you more money than the value of the home. This is a particularly useful advantage if you secure a Reverse Mortgage and then home prices decline. Reverse Mortgage Pros and Cons The biggest benefit for a homeowner is that a reverse mortgage allows them to access to useable cash.

You Must Be at Least 62 If you want a reverse mortgage insured through the FHA the youngest borrower needs to be 62. Reverse Mortgage 9 Pros and Cons By Ila Adhikari March 15 2020 Reading Time. Provides flexible disbursement options ie.

Monthly or line of credit Homeowner stays in the home without making monthly mortgage payments. That is why it is called a reverse mortgage the balance is going up not down. As home equity is used fewer assets are available to leave to your heirs.

No payments need to be made until you move out sell the house or die. Reverse mortgage pros You can better manage expenses in retirement Many seniors experience a significant income reduction when they retire. Pros of Reverse Mortgages.

Reverse mortgages can be expensive loans due to upfront financed origination fees. You can convert the equity in your home into a pile of cash without having to move out. Your home is increasing in value considerably.