For example if your account was reported as late to the credit bureaus in September 2020 and it charged-off in December 2020 the late payments and charge-off record would stay on your credit report until September 2027. An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years.

How Long Do Negative Items Stay On Your Credit Report Blue Water Credit

How Long Do Negative Items Stay On Your Credit Report Blue Water Credit

A default will stay on your credit file for six years from the date of default regardless of whether you pay off the debt.

How long does an account stay on your credit report. Bev OShea April 4 2019 Many or all of the products featured here are from. Heres where it really hurts. The length of time a closed credit card stays on your credit report depends on whether the account was closed in good standing.

How long does a default stay on your credit file. You can find a more comprehensive list of timeframes and explanations of them by learning more about when negative information is removed from a credit report. How Long Do Charge-Offs Stay on Your Credit Reports.

This generally helps your credit score. Even if you repay overdue bills the late payment wont fall off your credit report until. A settled account remains on your credit report for seven years from its original delinquency date.

Thats the maximum amount of time most negative information can be included on your credit report. You can read more in our QA about how long late payments stay on your credit report. Even after you pay the past-due bill it remains on your report for seven years starting from the original.

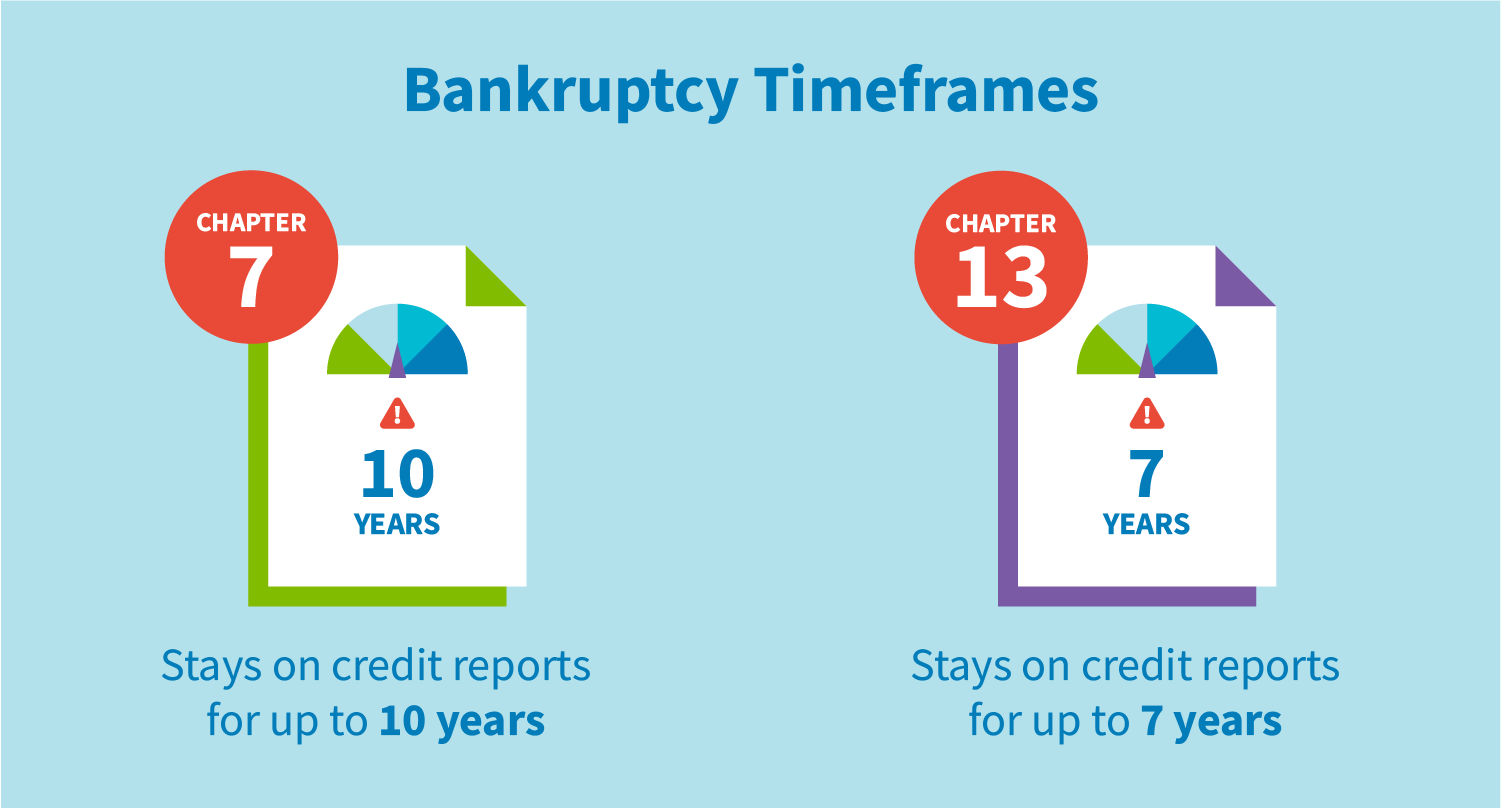

Some types of derogatory informationlike a bankruptcycan remain on your credit report for up to 10 years. The credit bureaus Experian TransUnion and Equifax keep a record of your accounts in good standing even after theyve been closed because its important for credit scoring systems to see their proper management. They can hurt your credit during this time making it more difficult to qualify for new loans or credit cards.

Accounts that you didnt pay like a charged-off credit card or installment loan balance can stay on your credit report for seven years from the date the debt was charged off. The statute of limitations doesnt have anything to do with how long a negative item can appear on your credit report. A negative closed account like a charged-off credit card will remain on your credit report for seven years.

If the charge-off first appears after six months of delinquency it will remain on your credit report for six and a half years There is nothing you can do to get a legitimate charge-off entry removed from your credit report. A charge-off is when. Bankruptcy can remain on your credit report for up to 10 years depending on the chapter filed.

Collection accounts stay on your credit report for seven years from the date the original account went past due. The Fair Credit Reporting Act specifies how long information can remain on a credit report. Collection accounts can remain on your report for seven years and 180 days from the original delinquency.

Even after a positive account has been closed or paid off it will still remain on your credit reports for as long as 10 years. Paying off the collection account may help but it wont remove the collection account right away. If you settled the debt five years ago theres almost certainly some time remaining before the seven-year period is reached.

Accounts with adverse information may stay on your credit report for up to seven years. Late payments remain on your credit reports for seven years from the original date of the delinquency. Your credit report represents the history of how youve managed your accounts.

How Long a Closed Account Stays on Your Credit Report. Late payments for example can stay on your report for seven years from the original delinquency. A charge-off stays on your credit report for seven years after the date the account in question first went delinquent.

Most other derogatory informationlate payments and debt collection accountswill only remain on your credit report for seven years. A late payment stays on your credit report for seven years. But the good news is that once your default is removed the lender wont be able to re-register it even if you still owe them money.

Most negative information stays on your credit report for 7 years. A hard inquiry stays on your credit report for about two years but it wont affect your score for longer than a year. The Fair Credit Reporting Act FCRA governs the length of time that negative information can remain on your credit report.