Make sure you only include the. Many people wonder how we figure their Social Security retirement benefit.

How To Calculate Your Social Security Benefits A Step By Step Guide Social Security Intelligence

How To Calculate Your Social Security Benefits A Step By Step Guide Social Security Intelligence

The Old-Age Survivors and Disability Insurance program OASDI taxmore commonly called the Social Security tax is calculated by taking a set percentage of your income from each paycheck.

How is your social security calculated. The average is the result of dividing the sum of the 35 highest amounts by the number of months in 35 years Such an average is called an average indexed monthly earnings AIME. Your Social Security benefit is based on your average indexed monthly earnings AIME. The SSA calculates your AIME by factoring in up to 35 years of your wage inflation-adjusted earnings.

Instead it will estimate your earnings based on information you provide. Benefit estimates depend on your date of birth and on your earnings history. Divide that average by 12.

It starts with Social Security examining your earnings history with an emphasis on the money you earned during your 35 highest-paid years. The formula for the AIME is. The year you were born the age you plan on electing begin taking benefits and your annual income in your working years.

So benefit estimates made by the Quick Calculator are rough. Retirement benefits or earned benefits are based on a workers earnings and the age that they decide to claim. Social Security Quick Calculator.

That means that if you worked 40 years Social Security would use your highest-paid 35 years in its calculations and ignore the other five. If you do not have 35 years of earnings a zero will be used in the calculation which will lower the average. The amount of a future Social Security benefit is by its nature an estimate though.

Social Security recalculates your benefit annually adjusting for inflationand figuring in the previous years income. First we take your annual income and we adjust it by the Average Wage Index AWI to get your indexed earnings. You can calculate this by looking at your annual income each year.

Social Security uses the highest 35 years of earnings to find the average amount that you earned for those years. Nominal earnings for case B are limited by the contribution and benefit base for all years. We adjust or index your actual earnings to account for changes in average wages since the year the earnings were received.

If your previous years income ranks in your top 35 years of earnings Social Security will shove aside a lower-earning year. If you were to reach full retirement age before applying for Social Security benefits the SSA would take an average of your annual income for your 35 highest earning years to find your AIME. If you understand this calculation you may be able to spot mistakes and fix them before its too late.

Its important for you to have a clear understanding of the process used to calculate your Social Security benefits. Given that Social Security is projected to run out of surplus funds by 2034 its likely that there will be changes to how Social Security benefits are calculated in the next couple of decades. How AIME Is Calculated The AIME chooses your top 35 best earning years till the age of 60 and breaks them down through a process called indexing This index approximates your wage growth and that wage growth is then averaged over the total number of months 420 to come up with a monthly amount.

How much money they earned during their working career The age they choose to start to receive benefits. How is Social Security calculated for retirement. Thats because a person who is eligible for Social Security gets a monthly benefit based on two factors.

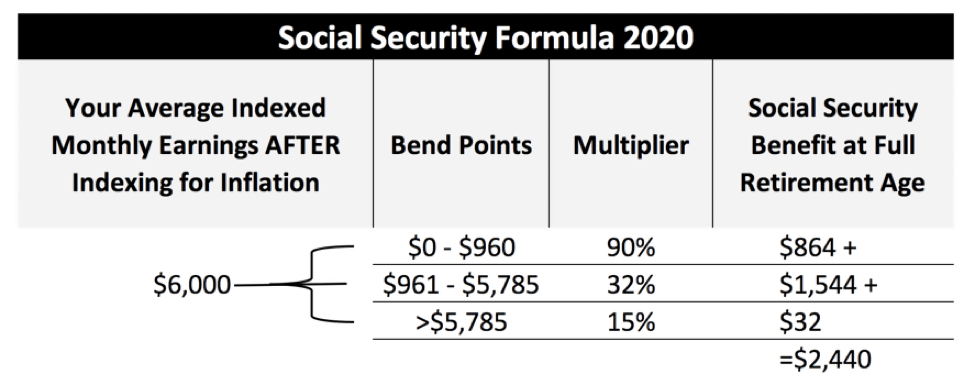

The Social Security benefits calculation uses your highest 35 years of earnings to calculate your average monthly earnings. Like anything with Social Security the rules can seem complex at first. The next step is to calculate benefits based on AIME amounts.

How Social Security Is Calculated The benefits you receive under Social Security differ based on several factors not least of which include your work history your collection status and which. Social Security benefits in retirement are impacted by three main criteria. The Social Security Administration bases those benefits on the highest 35 years of a workers salary history.

Finding the average means adding up all the salaries for the years and then dividing by 35 years. We base Social Security benefits on your lifetime earnings. For security the Quick Calculator does not access your earnings record.