In many cases you need good credit to be approved for a credit card which is usually defined as a credit score of 700 or higher according to Jeff Campbell founder of. So if your income isnt high enough and Chase isnt comfortable giving you that much credit then you wont be approved for the card.

How To Apply For A Credit Card Approval Requirements

How To Apply For A Credit Card Approval Requirements

Credit requirements vary.

/credit-card--concept-credit-card-payment-1156857742-c265746dcaea46e6bcc5f0bcda1ed871.jpg)

Requirements to get a credit card. In addition to specifying that card issuers cannot send unsolicited credit card offers to consumers under the age of 21 the CARD Act stipulates that solo credit card applicants must be at least 21 years old. Income must be from a job. The income requirements dont require you to work full-time to get a credit card.

The income or salary proof is mandatory to get a credit card. Even if you have little or no prior credit history a low or no FICO score and youve been denied for regular credit cards you may be able to get approved for a student credit card if. Its much easier to get approved for a student credit card than other cards but student credit cards still have minimum approval requirements.

You may be approved for one card but denied for another. Customer must be earning at least Rs. 1 Otherwise its likely youll have to have someone apply for a joint credit card with you.

Generally the lower your credit card debt and longer your history of on-time payments with other accounts the more likely it is youll be approved for credit cards with the lowest interest rates highest credit limits and best rewards. You can apply if you are at least 18 if you have a parents permission or a verifiable source of income. Specifically consumers aged 18 to 20 who can prove an independent source of income are eligible to apply for a personal credit card.

The minimum income requirement for basic credit cards typically sits above 12000 while for premium credit cards you could be required to make as much as 100000. Applicants also need a Social Security number SSN or an Individual Taxpayer Identification Number ITIN to get approved for a Visa though not all Visa card issuers will accept an ITIN. To apply for their credit card applicants must meet the following eligibility for credit card.

15001 per month Applicant should be between the ages of 21 and 60 years of age Credit history is not required in order to avail ICICI Bank credit card. However youll need to have a regular source of income before you can be approved for a credit card. Many credit card providers require you to earn a minimum annual income for a credit card.

Most Chase cards require a score of at least 600 which is about the dividing line between fair and poor credit. Credit score is a requirement to get a credit card the credit score ranges from 300-900. If an applicant is applying for the first time then a credit card with limited options is provided and credit card benefits will be revised based on the card payments.

You must be 21 years old to apply for a credit card in the United States. Different credit cards have different credit requirements. Freedom cards Southwest cards and Disney cards.

The CARD Act of 2009 is designed to prevent banks from certain dangerous practices like marketing credit products to. Visa credit card requirements include being at least 18 years old having enough income to pay the bills and living in a US. That said the CARD Act does provide a few exceptions to the rule.

Federal law requires adults younger than 21 to have verifiable income before they can be approved for a credit card without a cosigner. Basic requirements to get a credit card Be at least 21 years old or 18 with either a parents permission or a verifiable source of income. Besides good credit history Citibank has other requirements for those seeking a new credit card.

But if youre wondering exactly what credit score is needed to get a credit card the answer is not cut-and-dried. Getting approved for a first credit card can be tough especially if youre younger than 21 and more so if you dont have a job. The higher the score the better interest rate and rewards youll get.

The legal age to qualify for a credit card on your own is 18. You usually need a credit score of some kind to be approved for a credit card. 551 Credit Score Needed The Chase Slate credit card is a minimalist card with no rewards and relatively few perks.

Be at least 21-years-old at the time of opening the card or 18-years-old with parent permission or have a source of income Be able to provide your valid legal name home address and birth date Have a.

How To Choose A Business Credit Card Requirements To Get One

How To Choose A Business Credit Card Requirements To Get One

How To Apply For A Credit Card Approval Requirements

How To Apply For A Credit Card Approval Requirements

Citibank Credit Card Application Guide Get Free P2 000 Gcash

Citibank Credit Card Application Guide Get Free P2 000 Gcash

What Credit Card Do I Qualify For Discover

What Credit Card Do I Qualify For Discover

/credit-card--concept-credit-card-payment-1156857742-c265746dcaea46e6bcc5f0bcda1ed871.jpg) How To Qualify For A Credit Card

How To Qualify For A Credit Card

How Would I Will Be Eligible To Get A Credit Card Credit Cards In Singapore

How Would I Will Be Eligible To Get A Credit Card Credit Cards In Singapore

7 Important Credit Card Requirements Minimums To Apply Cardrates Com

7 Important Credit Card Requirements Minimums To Apply Cardrates Com

9 Merchant Account Requirements You Need To Process Credit Card Payments Payment Depot

9 Merchant Account Requirements You Need To Process Credit Card Payments Payment Depot

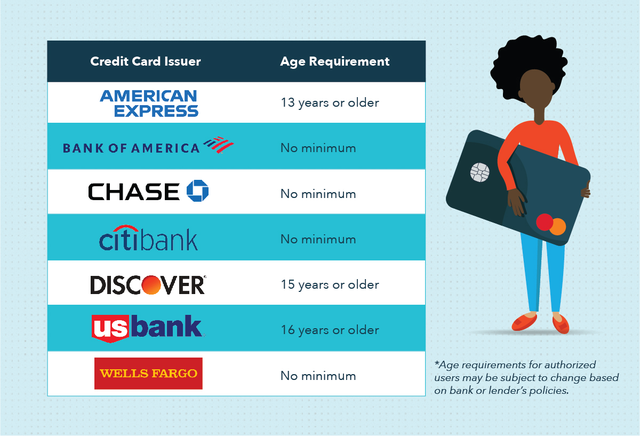

Credit Cards For Kids Can Minors Get A Credit Card Mint

Credit Cards For Kids Can Minors Get A Credit Card Mint

2019 Credit Card Requirements Eligibility In Malaysia Comparehero

2019 Credit Card Requirements Eligibility In Malaysia Comparehero

How To Apply For A Credit Card Approval Requirements

How To Apply For A Credit Card Approval Requirements

Credit Score Requirements For Credit Card Approval

Credit Score Requirements For Credit Card Approval

/credit-card--concept-credit-card-payment-1156857742-c265746dcaea46e6bcc5f0bcda1ed871.jpg) How To Qualify For A Credit Card

How To Qualify For A Credit Card

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.