And you have to prove that you can independently make the minimum payments on the accountno matter your age. If youre looking to apply for a credit card you may wonder if theres a best time to submit an application.

6 Facts To Know Before You Apply For Credit Card In India

6 Facts To Know Before You Apply For Credit Card In India

4 Once you submit.

When can you apply for a credit card. Following the passage of the Credit CARD Card Accountability Responsibility and Disclosure Act of 2009. When youre applying for your first credit card youre essentially asking a card issuer to take a chance on you says credit educator John Ulzheimer of The Ulzheimer Group. CNBC Select offers advice on the best times to apply for a credit card.

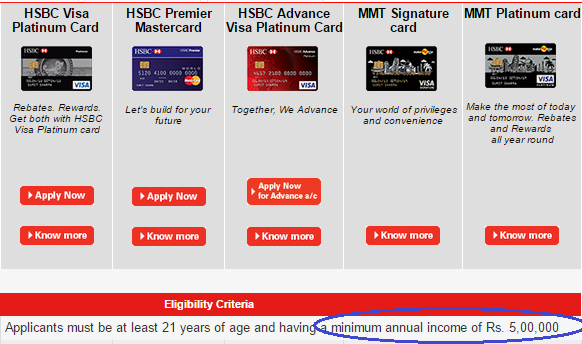

The 2009 CARD Act requires that you be at least 21 to open a credit card account. Before you can get approved for a credit card you need to apply for the credit card. This is the case when you are anticipating applying for a major loan such as a car loan or a home mortgage.

The key distinction is that you. Lenders can pull your credit up until the day of closing. When you apply for a new credit card you dont know how much of a credit line the bank will offer.

If you are under 21 you must provide proof of your independent income or assets to show that you will be able to repay the amount you charge. Thats why you shouldnt apply for credit cards or other loans before youve closed on your mortgage. Or if you cant someone with the ability to make payments will need to co-sign for you.

Typically you must be at least 18 to apply for a credit card. Your best bet is to apply for a card as soon as you can after your bankruptcy is discharged or completed so you can start rebuilding your credit right away. When you apply for a business credit card youre required to provide much of the same basic personal information you would for a consumer card.

The process can take approximately seven weeks so apply as soon as you realize you need an ITIN. You can do so by mail at walk-in IRS locations or through IRS-authorized Acceptance Agents. While applying for multiple new credit cards will have a modest effect on your credit score there are some times when its best to avoid applying for any new credit cards.

The Citi 865 rule specifies that you have to wait at least eight days after applying for a personal Citi card to apply for new one and that you cant apply for more than two cards within a 65-day. When Not to Apply for New Credit Cards. Online credit card applications are open to US residents-in other words people with a mailing address in the US who are over 18 and either have a Social Security Number SSN or Individual Tax Identification Number ITIN.

Knowing how to apply for a credit card is one thing but knowing what issuers are looking for before you apply for a new card is really the first step to success. Be prepared to provide various details about yourself and your financial background such as your annual household income and the amount of money in your bank and investment accounts. The exception is if you can show an independent source of income to make credit card payments.

You cant exactly predict a credit limit but you can look at averages. Even if youve received a preapproved credit offer you still need to complete the official application. While you need to submit pay stubs and income tax returns when you apply for other financial products like personal loans or a home mortgage credit card issuers dont typically require proof of.

Most creditworthy applicants with stable incomes can expect credit card credit limits between 3500 and 7500. Otherwise you will need to become an authorized user on your parents guardians or another adults account who is over the age of 21. But keep in mind that not all issuers allow co-signers.

You can apply for a credit card by mailing in a paper application speaking to a representative over the phone or completing an online application. Some of the income options listed below only apply to people over the age of 21 and its best practice to confirm with a credit card company what the requirements of an application are. You typically have to be at least 18 years old to open a credit card in your own name.

FAQs about applying for a credit card after mortgage approval Can I be denied a mortgage after the closing disclosure is issued.