The Alternative Reference Rates Committee ARRC in the US has significantly softened its target to make term Secured Overnight Financing Rates SOFR available. SOFR is a fully transaction-based rate and is less susceptible to market manipulation.

Sofr Sonia And Other Alternative Reference Rates

Sofr Sonia And Other Alternative Reference Rates

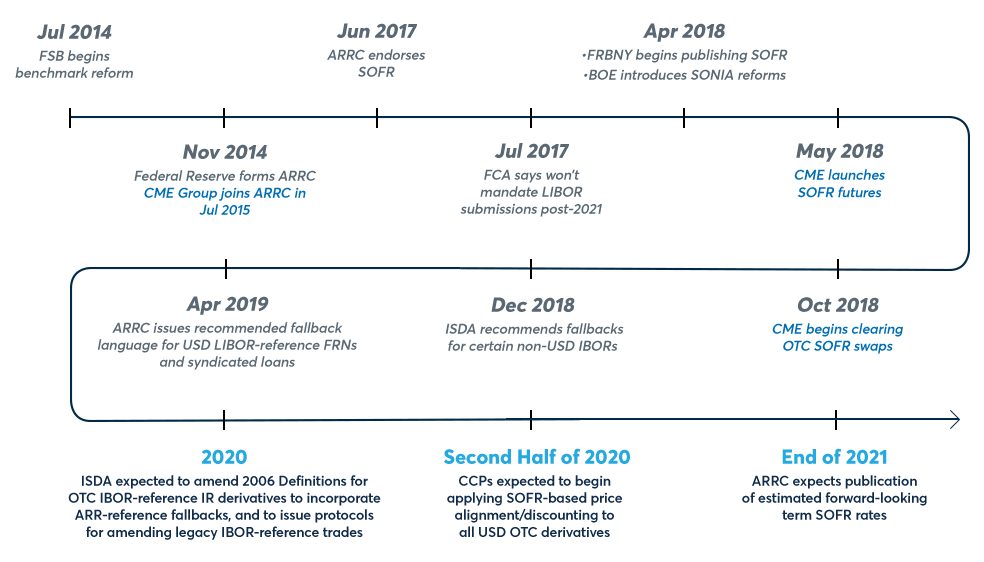

SOFR was selected by the Alternative Reference Rates Committee ARRC chaired by the New York Federal Reserve in 2017.

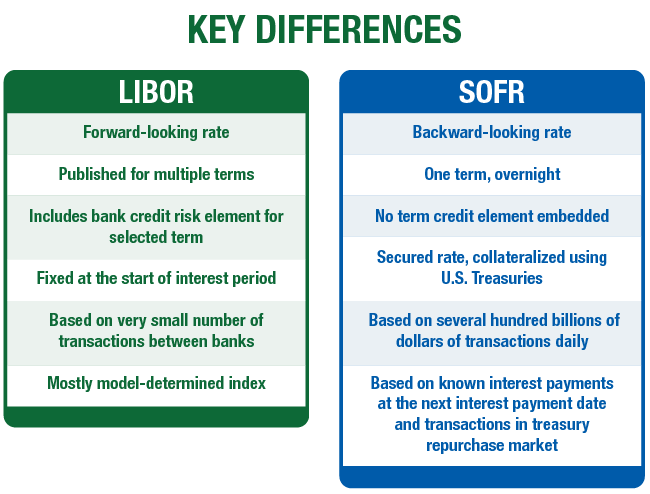

What is sofr. Term SOFR means the forward-looking term rate for any period that is approximately as determined by the Administrative Agent as long as any of the Interest Period options set forth in the definition of Interest Period and that is based on SOFR and that has been selected or recommended by the Relevant Governmental Body in each case as published on an information service as selected by the Administrative Agent from time to time in. What Is SOFR. While LIBOR is not fully transaction based SOFR is based on the overnight repo markets with 1 trillion of transactions per day.

There had been an implicit expectation for the term rate to become available at some point in 3Q21. Publication of the SOFR rate began in April 2018. Member feedback supported including an option for a hardwired transition to Term SOFR if an ARRC recommended Term SOFR were to exist in the future.

What is SOFR. The ARRC selected SOFR as the recommended alternative reference rate for the US. Those averages are quite smooth and have moved down recently with monetary policy rates.

What are term rates. SOFR is based on transactions in the overnight repurchase markets repo which. Although SOFR can exhibit some day -to-day volatility most notably in mid -September 2019 and year -end 2018 the SOFR -based financial products that have been issued all reference an average of SOFR.

Now the ARRC is suggesting that it might not come in 2021 at all. Transition to Term SOFR. The secured overnight financing rate SOFR is a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the London interbank offered rate LIBOR.

Trading and clearing of SOFR-based swaps and futures began in May 2018. The Secured Overnight Financing Rate SOFR is intended to replace the US dollar London Interbank Rate US LIBOR in future financial contracts. Reuters - The New York Federal Reserve on Tuesday will begin to publish the Secured Overnight Financing Rate SOFR a rate that regulators hope will eventually be adopted to back US.

Secured Overnight Financing Rate SOFR is an alternative USD interest rate benchmark. Averages of SOFR are smoother than LIBOR. SOFR futures are traded on an exchange and specify the average SOFR rate for delivery at various dates in the future.

SOFR measures of the cost of borrowing cash overnight collateralized by Treasury securities. On June 22 2017 the ARRC announced its preferred alternative reference rate. It compares the underlying interest rate exposures for SOFR futures versus those for other short-term interest rate futures both to indicate normal spread relationships and to highlight characteristics that futures users should bear in mind when hedging or spreading.

SOFR is a benchmark that financial institutions use to price loans for businesses and consumers. As discussed in the Users Guide to SOFR although compound interest will more accurately reflect the time value of money and will match the payment structure in derivatives and debt market simple interest is in some ways operationally easier to. It is important that parties weigh the potential benefits as well as the operational and potential hedging risks of shifting to Term SOFR.

The overnight financing part of its name references how SOFR sets rates for. The ARRC selected the Secured Overnight Financing Rate SOFR in 2017 as the appropriate replacement index and the New York Fed began publishing SOFR in April 2018. This note offers an introduction to the Secured Overnight Financing Rate SOFR and CME One-Month and Three-Month SOFR futures.

The organised structure of an exchange facilitates the data collection. The Secured Overnight Financing Rate SOFR. Learn about the features and mechanics of SOFR how they compare to ot.

The SOFR was designed and implemented by the Federal Reserve Bank of.