The maximum possible Social Security benefit for someone who retires at. If you make more than 18960 in 2021 for every 2 over the limit 1 of your Social Security benefit will be withheld.

How Early Retirement Reduces Projected Social Security Benefits

How Early Retirement Reduces Projected Social Security Benefits

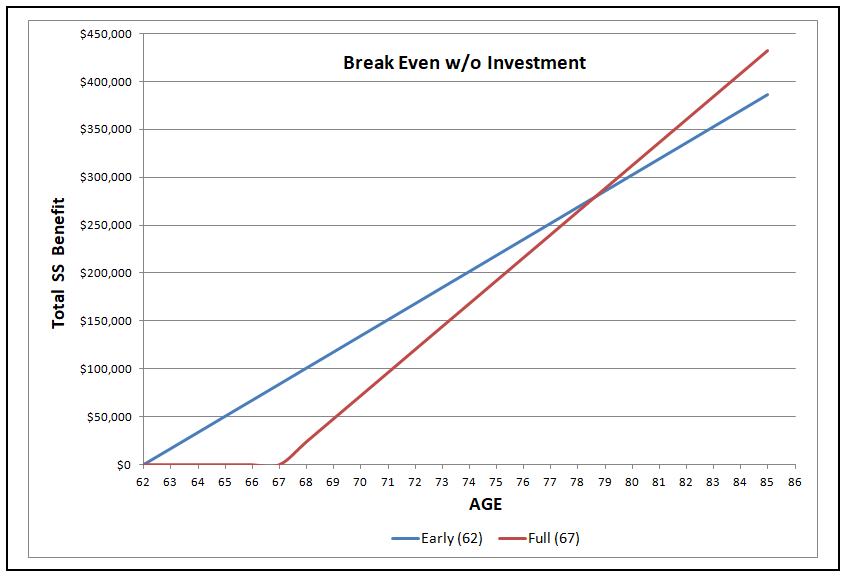

The table below shows how much a 1500 Social Security benefit could increase each month if you wait until your full retirement age to claim benefits.

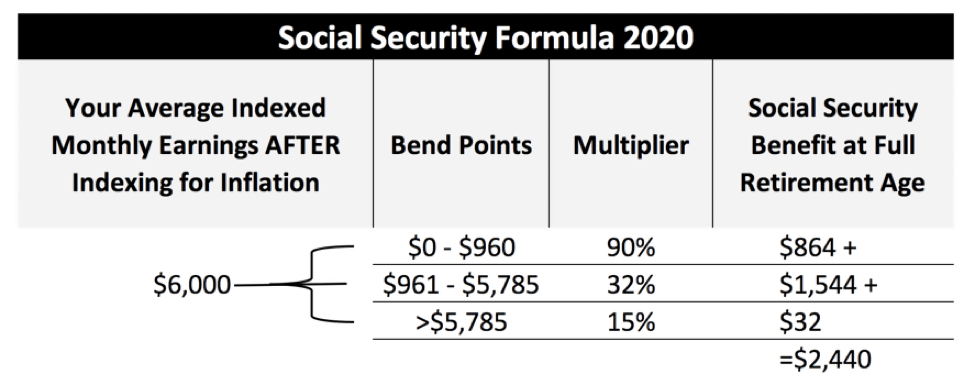

How much is social security retirement. The average Social Security benefit was 1543 per month in January 2021. Social Security benefits are earned by working jobs in which you pay FICA or self-employment taxes. Benefit estimates depend on your date of birth and on your earnings history.

The chart below shows the amount of a career-average wage that you could expect Social Security to replace if. The decline in availability of company-sponsored pensions since the 1970s has led to Social Security becoming one of the three legs of the retirement income stool along with retirement accounts like 401ks and personal savings. Instead it will estimate your earnings based on information you provide.

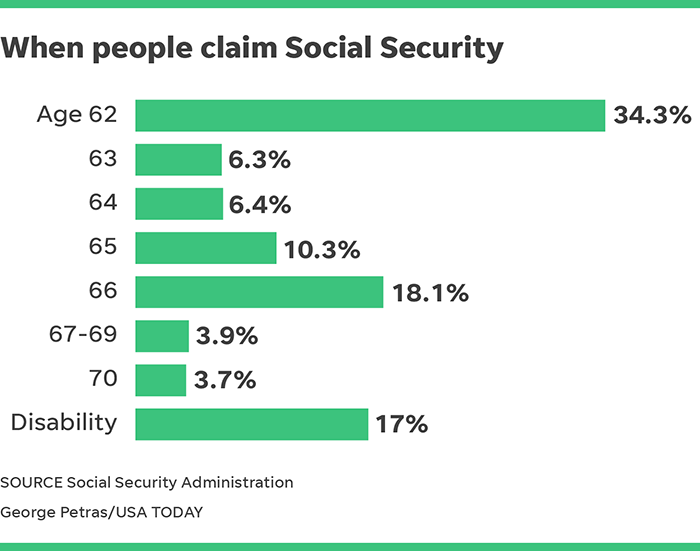

My social security election age. The amount you are entitled to is modified by other factors most crucially the age at which you claim benefits. If you receive the average Social Security benefit about 1431 per month relying on that for 90 of your income could leave you with around 19000 annually.

Social Security Quick Calculator. In 2021 the limit is 18950 for those reaching their full retirement age in. In the year you reach full retirement age we deduct 1 in benefits for every 3 you earn above a different limit but we only count earnings before the.

10 rows To find out how much your benefit will be reduced if you begin receiving benefits from age 62. If you earn less than the earnings limit which for 2020 is 18240 then your benefits will not be affected. 2 However for many Americans this amount may not be enough to cover basic living costs so its important to learn ways you can receive more.

So benefit estimates made by the Quick Calculator are rough. For reference the estimated average Social Security retirement benefit in 2021 is 1543 a month. The year you reach full retirement age this limit changes to 1 in benefits.

In 2020 the annual Social Security earnings limit for those reaching full retirement age FRA in 2021 or later is 18240. If you earn more than the earnings limit Social Security will deduct 1 for each 2 you earn over the limit. For security the Quick Calculator does not access your earnings record.

If you work after claiming your benefit one of two things can happen. How much pre-retirement income does Social Security replace. As of November 2020 the average Social Security check benefit for retired workers was 152270 per month.

So the taxable amount that you would enter on your federal income tax form is 5000 because it is lower than half of your annual Social Security benefit. For 2021 that limit is 18960. You will receive 40982 in annual social security payments starting at age 66.

This is far too little to live on. The difference between your combined income and your base amount which is 25000 for single filers is 5000. The annual payment you receive from Social Security is based on your income birth year and the age at which you elect to begin receiving benefits.

/social-security-ex-spouse-2388947_V3-49a27ada826c4b8a84d087f7178b9e84.png)