This is why its important to get the right advice about changing your blend of investments. If youre more into real estate you can use real estate investment trusts REITs to invest in a collective of apartment buildings commercial structures vacation properties and more.

5 Best Investments For Regular Income After Retirement

5 Best Investments For Regular Income After Retirement

Vanguard 500 Index Fund ticker.

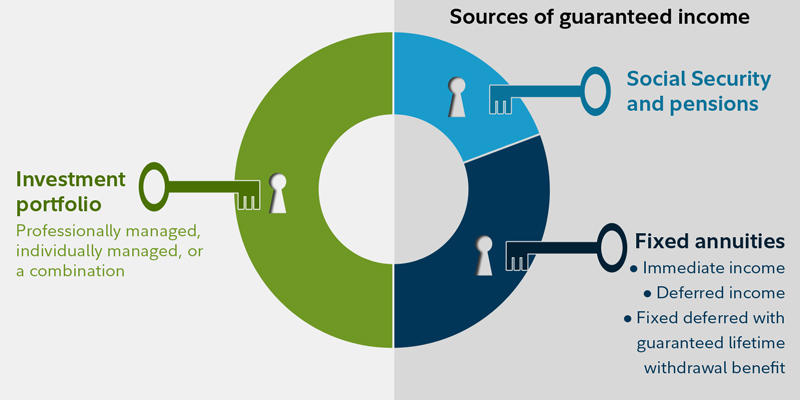

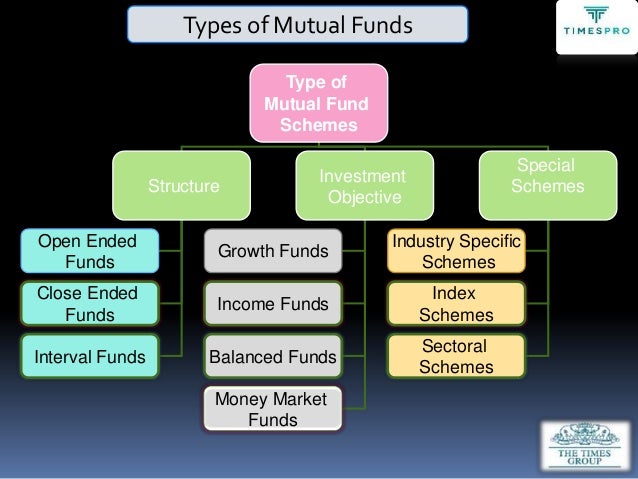

Best investments for retirement. From leading fund managers such as Vanguard and Fidelity here are seven of the best mutual funds for retirement. One type of mutual fund is a retirement income fund that allows you to invest your money in a diversified portfolio of stocks and bonds in one go. It is not a stand-alone investment.

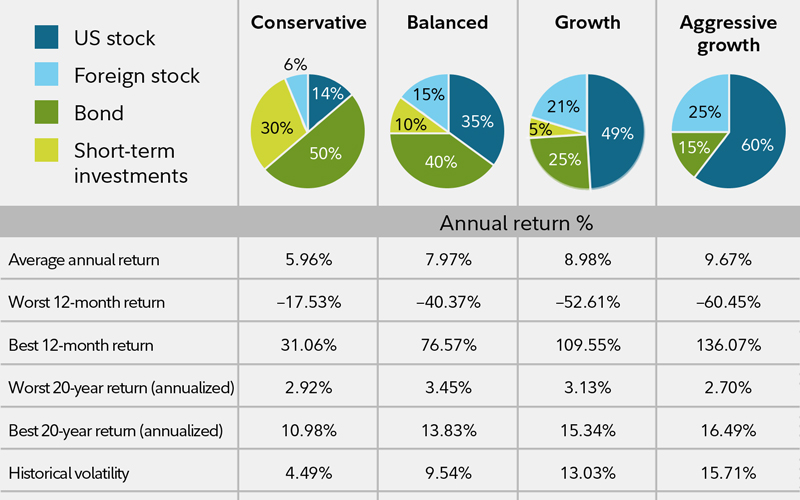

A person generally works for 30 years to save his other upcoming 30 years. It is a strategy that uses a balanced diverse blend of stock and bond index funds that provide retirement income in the form of interest dividends and capital gains. You may want to limit your investment risk to be sure of having enough money to last throughout retirement but also earn sufficient returns so that inflation wont reduce the value of your savings over time.

You can choose any investment option such as Fixed deposits debt funds equity funds or mixed-funds gold investments or the real-estate. Investing in a product designed with a. Vanguard Target Retirement 2015 symbol VTXVX which is designed for an investor on the cusp of retirement had 51 of its portfolio in stocks and 45 in bonds at last report.

Among the names worth considering are BestInvest cheapest for small savings pots Barclays Stockbrokers Fidelity Interactive Investor iWeb and. When done right a total return portfolio is one of the best retirement investments out there. A few good funds that invest along these lines are the Vanguard Wellesley Fund VWIAX the Vanguard Balanced Fund VBIAX and the Vanguard Wellington Fund VWELX.

You should follow the ideology of your age base and accordingly you should design your portfolio for retirement. Many people invest primarily for retirement with both employer-sponsored retirement plans and self-directed retirement plans playing an important role. While you probably dont have as much say in your employer-based 401k 403b or 457 plan you should have plenty of freedom with self-directed individual retirement accounts IRAs.

An investment strategy that works well for you whilst working full-time may need to change when your goal is having an income to rely on in your retirement years. Vanguard Target Retirement funds are one of the best options for long-term investing says Dejan Ilijevski president at Sabela Capital Markets.

How Expensive Is It To Plan Your Retirement In 40s Instead Of 30s

How Expensive Is It To Plan Your Retirement In 40s Instead Of 30s

/HiRes-57c48a5a5f9b5855e5d21768.jpg) How To Choose The Best Retirement Investments For Your Portfolio

How To Choose The Best Retirement Investments For Your Portfolio

/saving-for-retirement-with-a-late-start-38e3bb030ef242649b53f1ad16826b10.png) 7 Tips For Saving For Retirement If You Started Late

7 Tips For Saving For Retirement If You Started Late

/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png) The Best Retirement Plans To Build Your Nest Egg

The Best Retirement Plans To Build Your Nest Egg

Best Way To Invest Money After Retirement Invest Walls

Best Way To Invest Money After Retirement Invest Walls

Infographic Good Investment Ideas Investing Infographic Best Investments Investing

Infographic Good Investment Ideas Investing Infographic Best Investments Investing

6 Best Investments For Retirement

6 Best Investments For Retirement

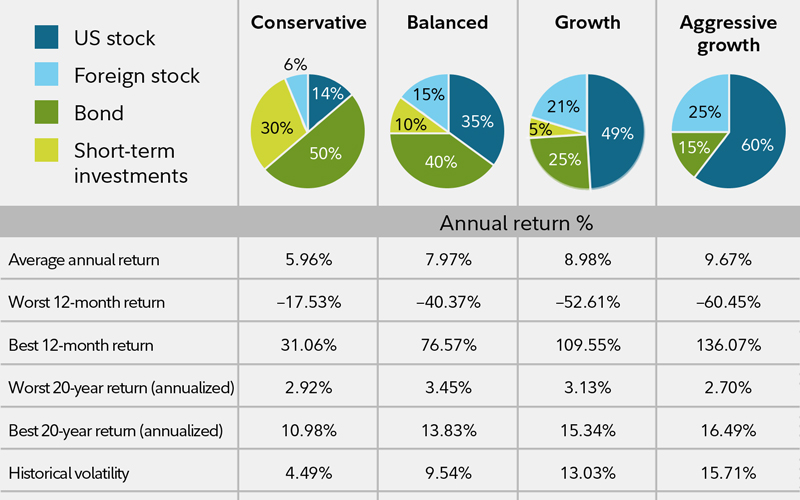

Retirement Income Coming Up With A Plan Fidelity

Retirement Income Coming Up With A Plan Fidelity

Managing Savings And Investments Before And After Retirement Smart About Money

Managing Savings And Investments Before And After Retirement Smart About Money

Best Investments For Retirement Plan

Best Investments For Retirement Plan

/how-much-should-i-put-in-my-401k-410a513b95894b9db05bb2897cec881e.png) How Much Should I Put Aside For Retirement

How Much Should I Put Aside For Retirement

Best Retirement Strategies For Achieving Financial Freedom Fortunebuilders

Best Retirement Strategies For Achieving Financial Freedom Fortunebuilders

Top 10 Best Investment Plans In India 2021 With High Returns

Top 10 Best Investment Plans In India 2021 With High Returns

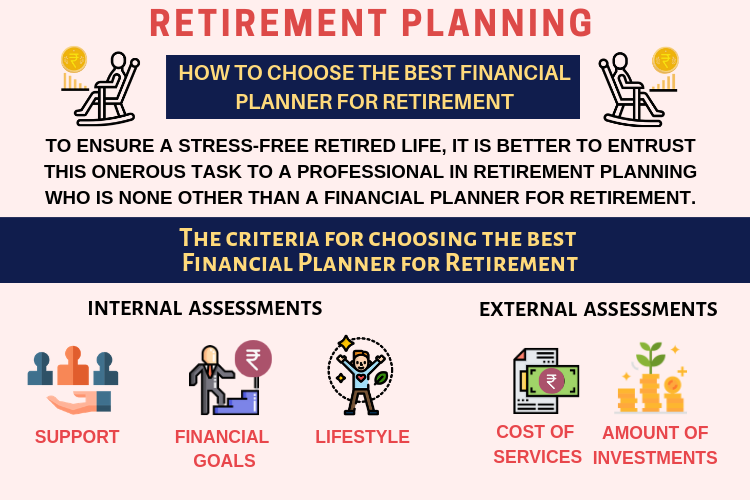

How To Choose The Best Financial Planner For Retirement

How To Choose The Best Financial Planner For Retirement

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.