Tools machinery or equipment used and other long-lasting commodities and the rate of real work done. You need proof of income for things like.

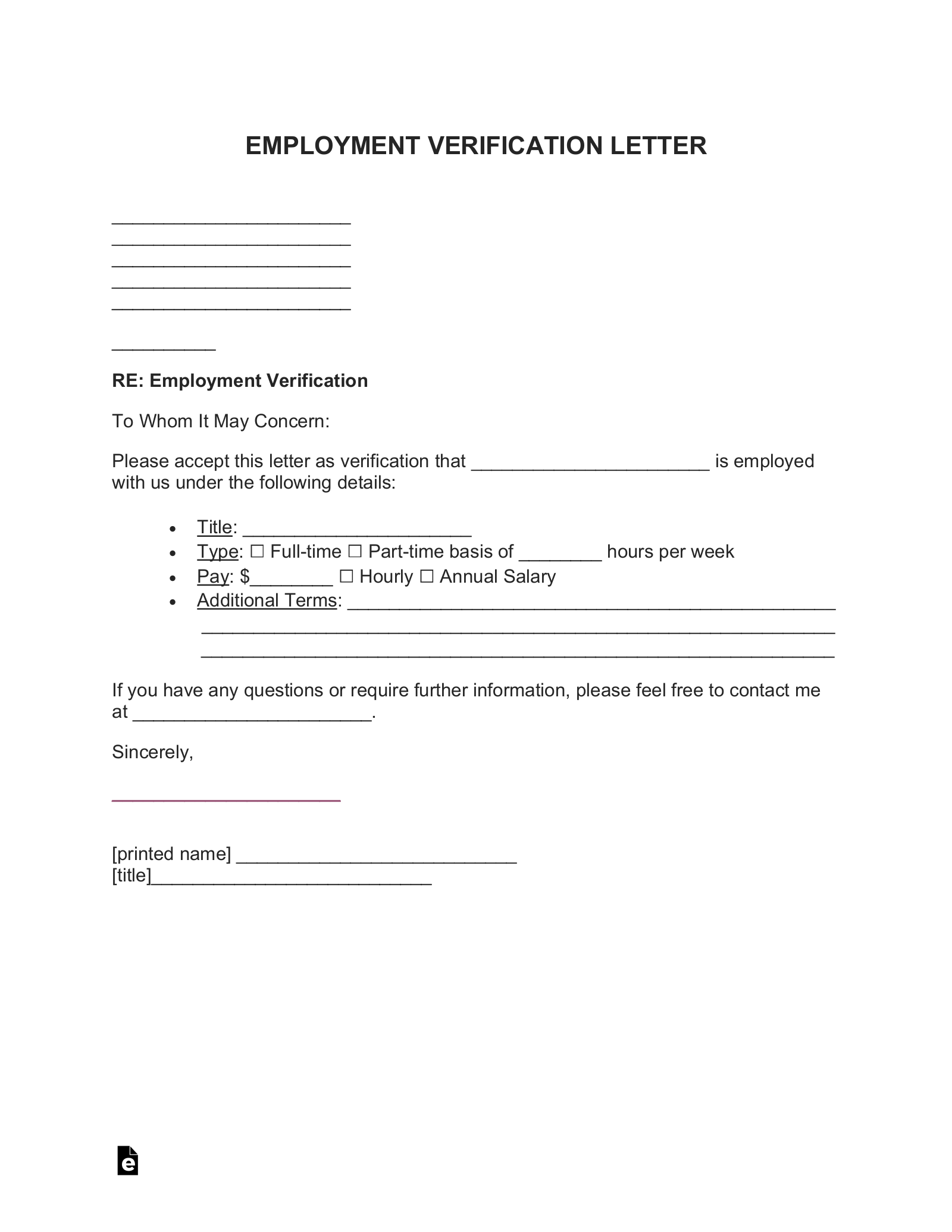

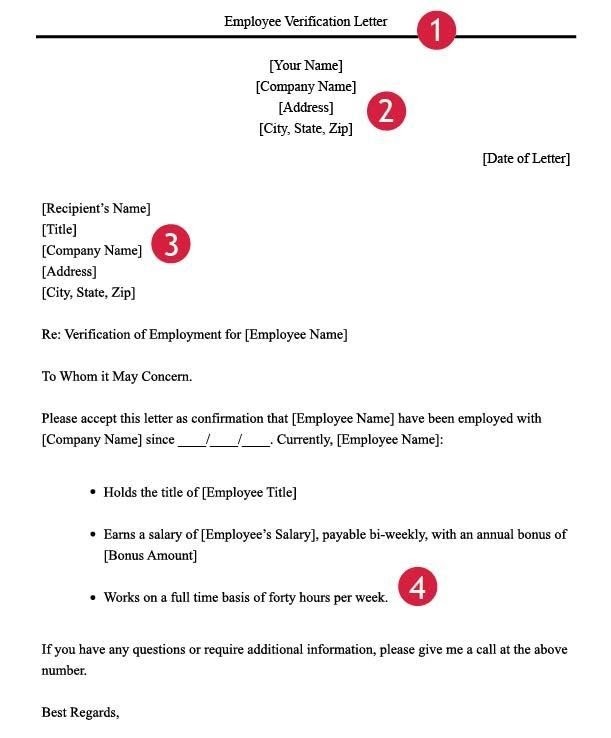

Proof Of Income Letter Lettering Letter Of Employment Letter Templates

Proof Of Income Letter Lettering Letter Of Employment Letter Templates

Need To Make Proof of Income Employment.

How to fake self employment income. It can be easy however to misidentify certain expenses or deposits. Proof of income is the documentation to prove your ability to pay for certain products and services. As the authentic document owner you are responsible for providing us with legitimate identity details in order for us to complete your order and process your proof of income replica copy.

Yes the IRS will figure it out. Related to your self-employed. It includes payments on major purchases.

In addition to sums that you earn in exchange for work or selling products self-employment income can also derive from an asset or work you have completed. If that individual is working two or even three ZHCs or short-hours contracts each of 15 hours earning 5000 in each he must aggregate his income for tax. Take a look at the documents below to see what you can use to prove your income when you are self-employed.

If youre a self-employed individual youll need to find a way to create this proof. Setting up a separate account for business purposes alone is a perfect way to disassociate your personal and professional expenses and deposits. Programs proof of income software stub stubs tax calculator tax help wages work work at home Print out Fake Employment and Fake Income Wages 1099 w2 w-2 using your home computer printer.

Print out Fake Employment and Fake Income Wages 1099 w2. Need more career advice. Make copies of all receipts statements bills invoices etc.

If youre trying to get a good job or rent from an apartment complex It is easy to show income or employment verification if you are self employed or dont. Keep scrolling our blog for more. For 899 youll receive a printable file within minutes that includes a background similar to the background found on paycheck stub stock.

Rent and mortgage agreements. If youre self-employed you have to come up with these proofs on your own. Only about 6 months are probably necessary and you dont need to show them every line item on there just have the balance of your account at months end for the last 6 to 8 months or so and that should suffice.

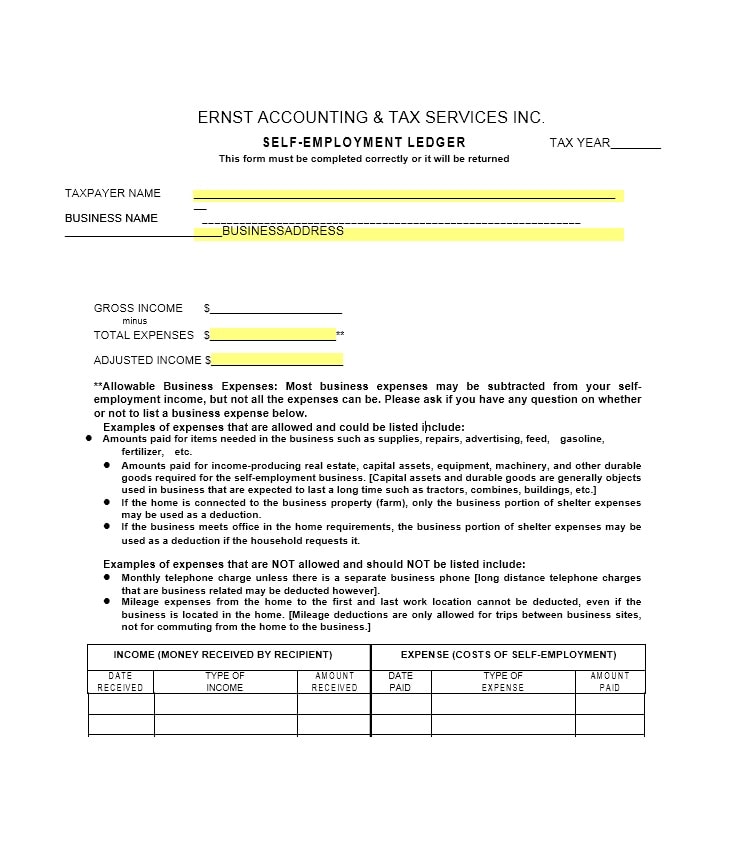

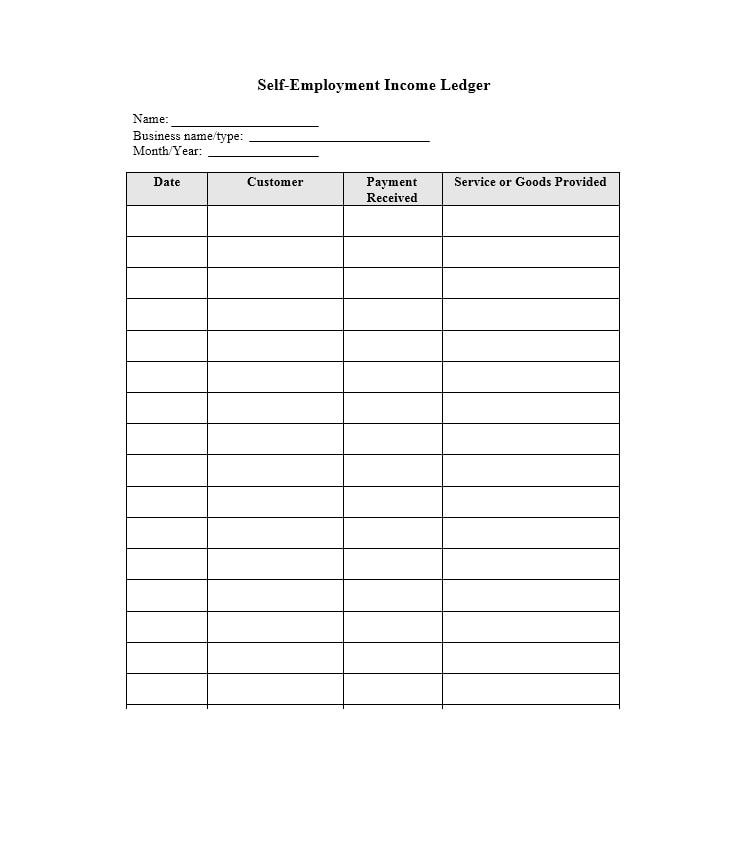

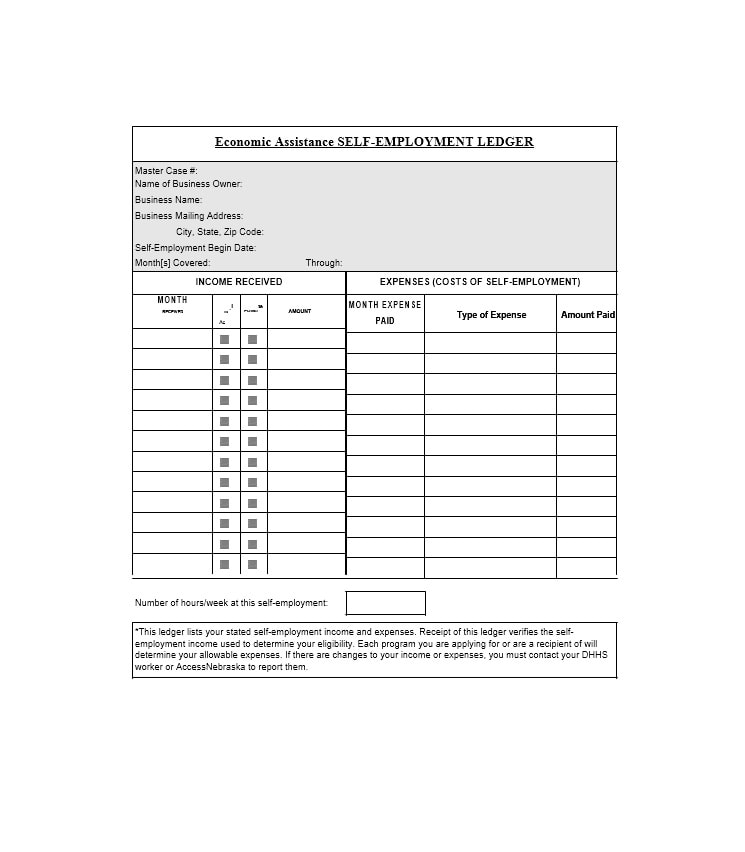

For example if you receive income from. But he is not allowed to aggregate. For further completing the self-employment ledger form write down all accepted business expenses monthly expenditure.

This scam involves inflating or including income on a tax return that was never earned either as wages or as self-employment income usually in order to maximize refundable credits. Having your tax return income statement and bank statement all in the same place can help you prove your income easily. We make it easy to access your novelty document online at any time.

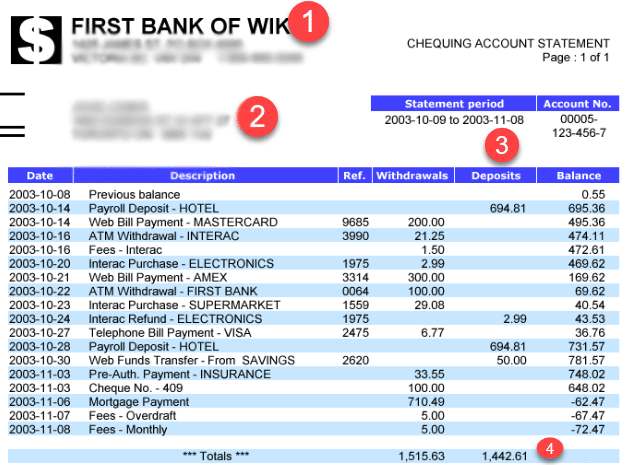

Accepted business expenses could be deducted from your self-employment income. False self-employment is a situation in which somebody registered as self-employed a freelancer or a temp is de facto an employee carrying out a professional activity under the authority and subordination of another company. Bank statements are a great resource when it comes to tracking and proving income when you are self-employed.

Proof of Income for Self Employed Individuals. Wage and Tax Statement for Self Employed. The above instructions on creating a 1099 pay stub can help immensely.

Proof of income is an important element of any major adult transaction. Proving income while self-employed can take a little extra effort if you dont keep yourself organized. Just like falsely claiming an expense or deduction you did not pay claiming income you did not earn in order to secure larger refundable credits such as the Earned Income Tax Credit could have serious repercussions.

Filing taxes can be difficult for self-employed individuals particularly in the first year of business. For more on how to verify self-employment and other insights into the subtle art of being an entrepreneur check out our other awesome blogs today. Such false self-employment is often a way to circumvent social welfare and employment legislation for example by avoiding employers social security and income tax contributions.

Proof of income usually involves pay stubs and letters from employers. Bring them your bank statements when you go in for the interview. Our novelty proof of income document is available in both printed and digital format.

While a modern gig economy encourages more casual employment. It takes nothing more than someone filling out a form online to steal your tax refund nothing more than fake numbers to steal your or your dependents SSNs when filing nothing more than fake salary to increase that number to 10K. Some sites go far to suggest authenticity with names like Real Check Stubs but you can enter whatever information youd like and no one verifies it.

Luckily for you then showing proof of income self-employed or not is much easier than most people think.

Create Pay Stubs Instantly Generate Check Stubs Form Pros

Create Pay Stubs Instantly Generate Check Stubs Form Pros

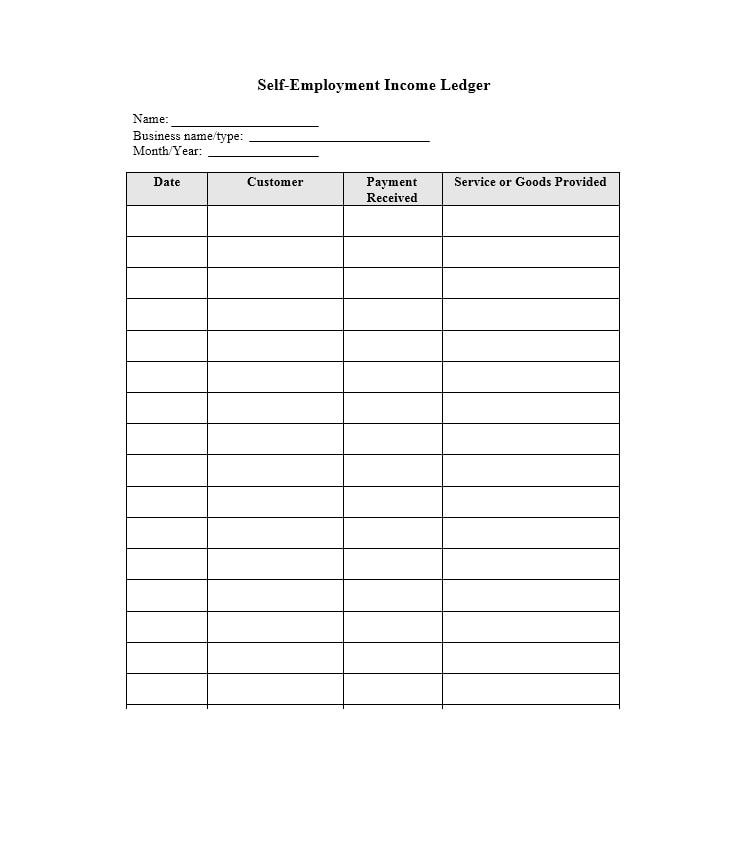

Self Employment Ledger 40 Free Templates Examples

Self Employment Ledger 40 Free Templates Examples

7 Ways Landlords Can Verify Proof Of Income

7 Ways Landlords Can Verify Proof Of Income

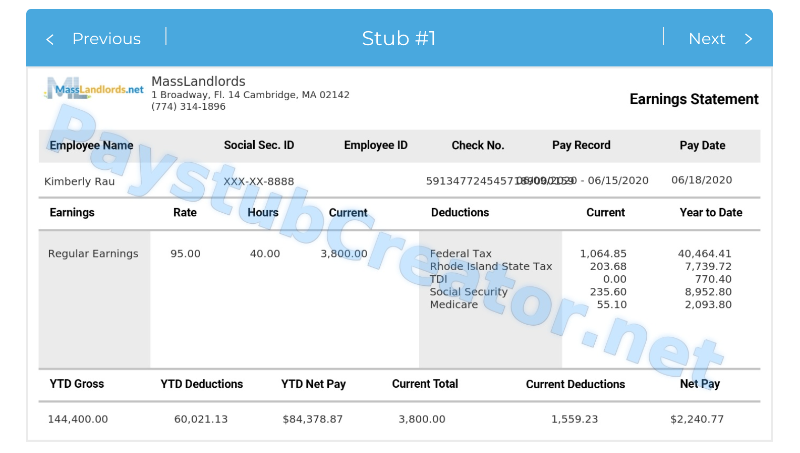

Fake Pay Stubs The Easiest Proof Of Income You Never Want To See Masslandlords Net

Fake Pay Stubs The Easiest Proof Of Income You Never Want To See Masslandlords Net

Free Employment Income Verification Letter Pdf Word Eforms

Free Employment Income Verification Letter Pdf Word Eforms

7 Ways Landlords Can Verify Proof Of Income

7 Ways Landlords Can Verify Proof Of Income

Tips On Proving Income When Self Employed

Tips On Proving Income When Self Employed

12 Self Employment Ideas Business Finance Business Tax Tax Write Offs

12 Self Employment Ideas Business Finance Business Tax Tax Write Offs

Self Employment Ledger 40 Free Templates Examples

Self Employment Ledger 40 Free Templates Examples

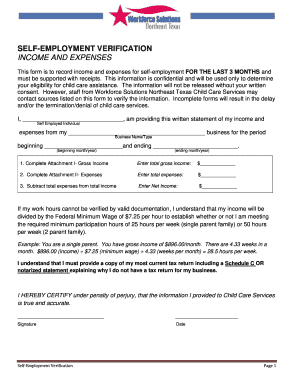

21 Printable Income Verification Letter For Self Employed Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

21 Printable Income Verification Letter For Self Employed Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

7 Ways Landlords Can Verify Proof Of Income

7 Ways Landlords Can Verify Proof Of Income

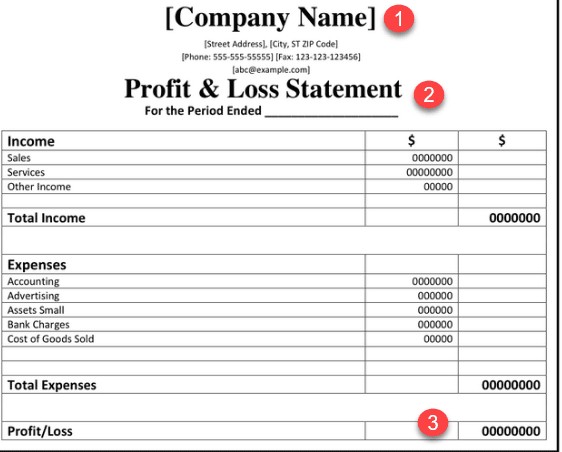

Self Employment Income Statement Template Awesome Profit And Loss Statement For Self Employed Template Free Statement Template Self Employment Income Statement

Self Employment Income Statement Template Awesome Profit And Loss Statement For Self Employed Template Free Statement Template Self Employment Income Statement

Self Employment Ledger 40 Free Templates Examples

Self Employment Ledger 40 Free Templates Examples

Tax Return Fake Tax Return Income Statement Income Tax Return

Tax Return Fake Tax Return Income Statement Income Tax Return

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.