The trust needs to be irrevocable which means your. Ad Turnkey display software for Radar AIS and CCTV integration.

What Is Irrevocable Asset Protection Trust How Does It Help In Asset Protection

What Is Irrevocable Asset Protection Trust How Does It Help In Asset Protection

Local government has been cracking down on those intentionally using Trusts to gift their property to their family and avoid fees.

How to protect your assets from nursing homes. Save Time Money. Basically Medicare is a federal program intended to help individuals cover medical expenses when they turn 65. Offshore Critical Infrastructure and Asset Protection.

If your total available assets is greater than the asset limit you do not qualify for Medicaid. Ad Turnkey display software for Radar AIS and CCTV integration. When created for the purpose of protecting assets from being used for nursing home or other long-term care costs the term Medicaid trust may be used to describe this type of irrevocable trust.

It is illegal to hide money from the government but a living trust helps you shelter. Ad Protect your family and property. Offshore Critical Infrastructure and Asset Protection.

Probably because there is such a trust an irrevocable trust. But if the house was over the 560K limit an option would be to sell the house to the children remember if an asset is sold for fair-market value it is not a Medicaid gift subject to the Medicaid penalty period and then shelter the money using a number of Medicaid-planning strategies personal services contract special needs trust spend down etc. Even if you wouldnt normally fall into the low-income category there are ways to shelter your assets and increase your chances of eligibility for nursing home care coverage.

When assets are put into irrevocable trusts they no longer belong to you because you name an independent trustee. However Medicare with minor exceptions does not pay for nursing homes. Set up a trust.

Compare this with a revocable or living trust which offers no asset protection for Medicaid purposes because the government considers the assets in a revocable trust to still be your property. In the case of nursing home costs you want to set up a living trust. Option 2 of the top ten ways to protect your money and house from Medicaid or a nursing home is using an asset protection trust continued from above You dont have to give up all control over your property if you put it into a Medicaid asset protection trust.

Save Time Money. Irrevocable trusts are an excellent alternative to giving assets as gifts. Heres how this works especially if youre going to use a trust.

Properly executed you may protect your assets from nursing home expenses if and its a big if those assets were transferred to an irrevocable trust at least five years before you go into a nursing home. Hiding money from social services and protecting your assets from nursing homes expenses is also against the rules of the law. They would rather their kids have it than a nursing home.

A key component to proper planning is setting up a trust. Ad Protect your family and property. While you may not own those assets you can use them while youre still alive.

An irrevocable trust is truly irrevocable. Many people are confused about the differences between Medicare and Medicaid. How do I protect my assets from nursing home expenses.

Oftentimes people want to transfer money to a trust or give it away to protect those assets for their kids. Unlike Medicaid there are no financial requirements for Medicare. The Nursing Home Spouses Retirement Accounts are not exempt and are an available asset and.

How To Protect Assets From Nursing Home Expenses 13 Steps

How To Protect Assets From Nursing Home Expenses 13 Steps

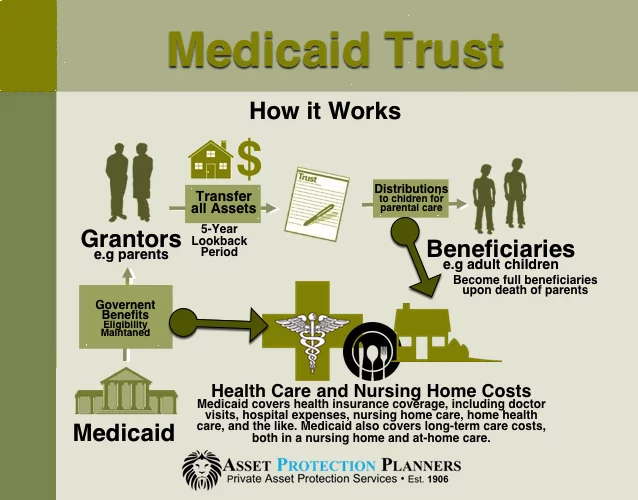

Medicaid Trust For Asset Protection From Nursing Home Costs

Medicaid Trust For Asset Protection From Nursing Home Costs

6 Steps To Protecting Your Assets From Nursing Home Care Costs Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc

6 Steps To Protecting Your Assets From Nursing Home Care Costs Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc

How To Protect Your Assets From Nursing Home Costs Legalzoom Com

How To Protect Your Assets From Nursing Home Costs Legalzoom Com

6 Steps To Protecting Your Assets From Nursing Home Care Costs Best Medicaid Asset Protection Trusts And Estate Planning Lawyer Las Cruces

6 Steps To Protecting Your Assets From Nursing Home Care Costs Best Medicaid Asset Protection Trusts And Estate Planning Lawyer Las Cruces

Kindle Onlilne How To Protect Your Family S Assets From Devastatin

Kindle Onlilne How To Protect Your Family S Assets From Devastatin

How To Protect Your Assets From The Costs Of Nursing Home Care

How To Protect Your Assets From The Costs Of Nursing Home Care

Estate Planning Watertown Protect Your Assets From Nursing Homes

Estate Planning Watertown Protect Your Assets From Nursing Homes

How To Protect Your Assets From Probate Plus Lawsuits Plus Nursing Home Expenses With The Living Trust Plus Farr Cela Evan H 9780976182139 Amazon Com Books

How To Protect Your Assets From Probate Plus Lawsuits Plus Nursing Home Expenses With The Living Trust Plus Farr Cela Evan H 9780976182139 Amazon Com Books

Family Money Protection Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc

Family Money Protection Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc

6 Steps To Protecting Your Assets From Nursing Home Care Costs Best Medicaid Asset Protection Trusts And Estate Planning Lawyer Las Cruces

6 Steps To Protecting Your Assets From Nursing Home Care Costs Best Medicaid Asset Protection Trusts And Estate Planning Lawyer Las Cruces

How To Protect Your Family S Assets From Devastating Nursing Home Costs Medicaid Secrets 14th Ed Heiser K Gabriel 9045650152229 Amazon Com Books

How To Protect Your Family S Assets From Devastating Nursing Home Costs Medicaid Secrets 14th Ed Heiser K Gabriel 9045650152229 Amazon Com Books

How To Protect Your Assets From Nursing Homes

How To Protect Your Assets From Nursing Homes

Pdf Read Online How To Protect Your Family S Assets From Devastatin

Pdf Read Online How To Protect Your Family S Assets From Devastatin

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.