Each account has different purposes. An IRA or Individual Retirement Account is a retirement-based account that helps you take advantage of the tax incentives that come with them.

What Is An Individual Retirement Account Ira Nerdwallet

What Is An Individual Retirement Account Ira Nerdwallet

Disbursement help free help.

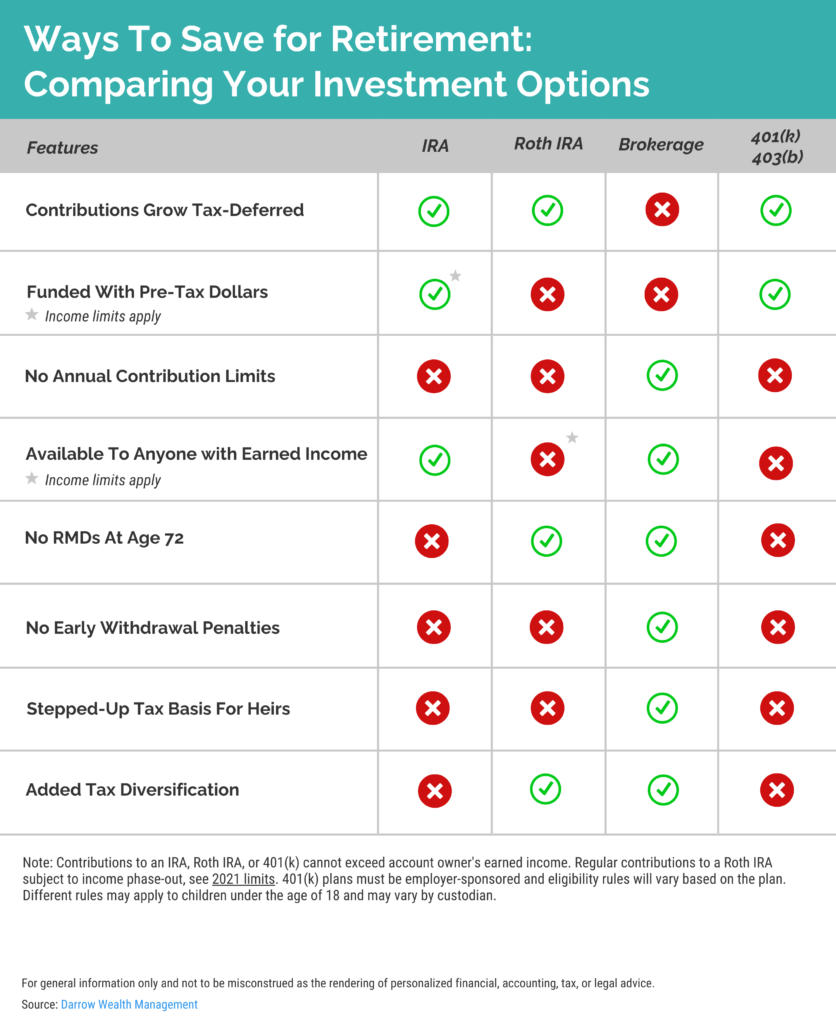

Ira vs investment account. A traditional IRA allows tax deductions for contributions toward the account and the taxes are deferred on the potential investment earnings until the funds are withdrawn. However IRAs penalize you for taking money out early while stock accounts offer the potential for lower long-term capital gains rates. Within certain limitations you get to.

The account thats right for you depends on your investment. It is an account in which you keep investments such as stocks bonds and mutual funds. For this reason a taxable brokerage account may be more beneficial for wealthy individuals in higher tax brackets compared to traditional IRAs where withdrawals are taxed as ordinary income.

Disbursement help free help. Ad 46000000 Register users 178 Countries Supported and over 1800000 Active Investors. In contrast investment IRAs take the form of stocks bonds or mutual funds and the FDIC offers you no protection if these securities lose value.

IRA is short for individual retirement arrangement. For some investors this rate is lower than their federal income tax rate. An important distinction is that an IRA is not an investment itself.

Ad 46000000 Register users 178 Countries Supported and over 1800000 Active Investors. A brokerage account on the other hand is a. For those who qualify traditional IRA contributions are tax-deductible in the year they are made.

Learn How To Invest Right Here. Others may call it a retirement plan. An individual retirement account IRA is a tax-advantaged account that individuals use to save and invest for retirement.

Wide Ranges of Assets Investment Types. Taxable Brokerage Accounts vs IRA Accounts Tax-sheltered or tax-deferred investment accounts flip the pros and cons of taxable brokerage accounts and all the restrictions on contributions withdrawals and management make them truly designed for long-term investing. A traditional IRA is a tax-deferred investment account.

Ad Non Resident Alien from the US Retirement Withdrawal 401k US. IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax. Learn How To Invest Right Here.

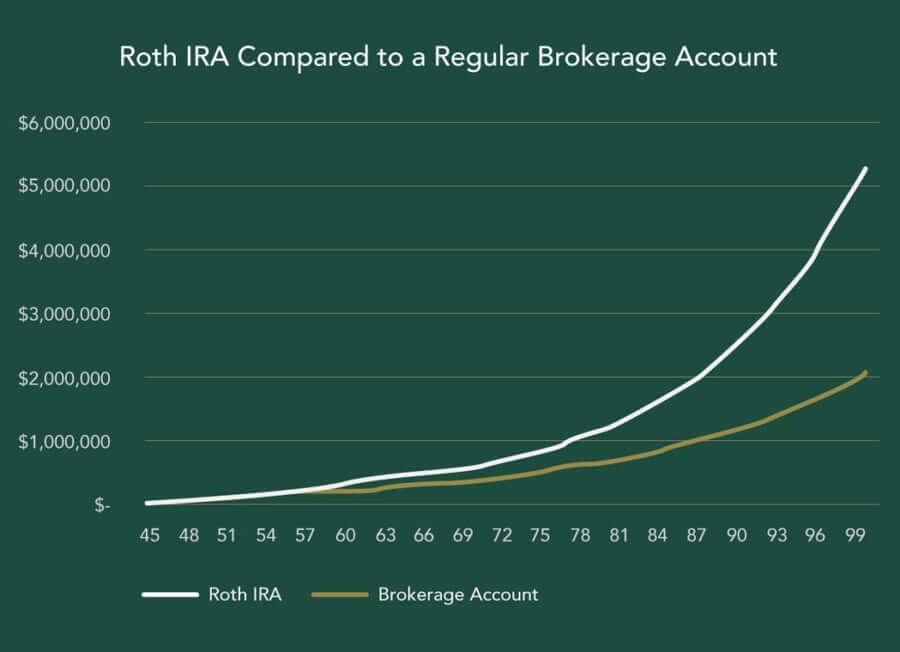

Most investors think it stands for individual retirement account though. Morningstars director of personal finance Christine Benz also recommends investing in a Roth IRA before opening a brokerage account. Broadly speaking a brokerage account is for investing in the stock market while IRAs focus on retirement planning.

Ad Non Resident Alien from the US Retirement Withdrawal 401k US. Covers losses stemming from your broker going bankrupt but only if you broker is an SIPC member. IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax.

However the Securities Investor Protection Corp. While the money is in the account. Investing in something that gives you a tax break will.

Wide Ranges of Assets Investment Types.

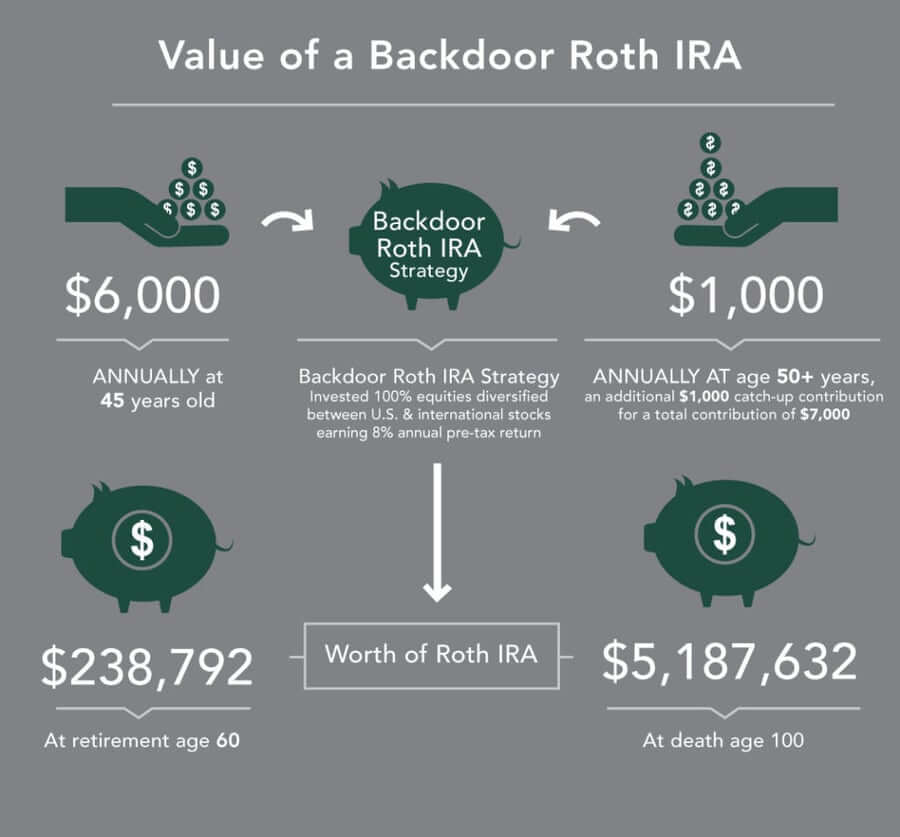

What You Should Know About Backdoor Roth Iras Vs Brokerage Accounts

What You Should Know About Backdoor Roth Iras Vs Brokerage Accounts

Asset Location For Stocks Brokerage Account Vs Ira

Asset Location For Stocks Brokerage Account Vs Ira

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

Asset Location For Stocks Brokerage Account Vs Ira

Asset Location For Stocks Brokerage Account Vs Ira

How Brokerage Accounts Are Taxed In 2021 A Guide

How Brokerage Accounts Are Taxed In 2021 A Guide

Investing Beyond Your 401 K How To Do It And Why You Should

Investing Beyond Your 401 K How To Do It And Why You Should

Asset Location For Stocks Brokerage Account Vs Ira

Asset Location For Stocks Brokerage Account Vs Ira

Brokerage Account Vs Ira What S The Right Move The Ascent

Brokerage Account Vs Ira What S The Right Move The Ascent

How Does Retirement Work How To Maximize Benefits

How Does Retirement Work How To Maximize Benefits

Roth Ira Or Traditional Ira Or 401 K Fidelity

Roth Ira Or Traditional Ira Or 401 K Fidelity

What Is A Brokerage Account Reasons To Use A Brokerage Account

What Is A Brokerage Account Reasons To Use A Brokerage Account

What You Should Know About Backdoor Roth Iras Vs Brokerage Accounts

What You Should Know About Backdoor Roth Iras Vs Brokerage Accounts

Asset Location For Stocks Brokerage Account Vs Ira

Asset Location For Stocks Brokerage Account Vs Ira

Asset Location For Stocks Brokerage Account Vs Ira

Asset Location For Stocks Brokerage Account Vs Ira

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.