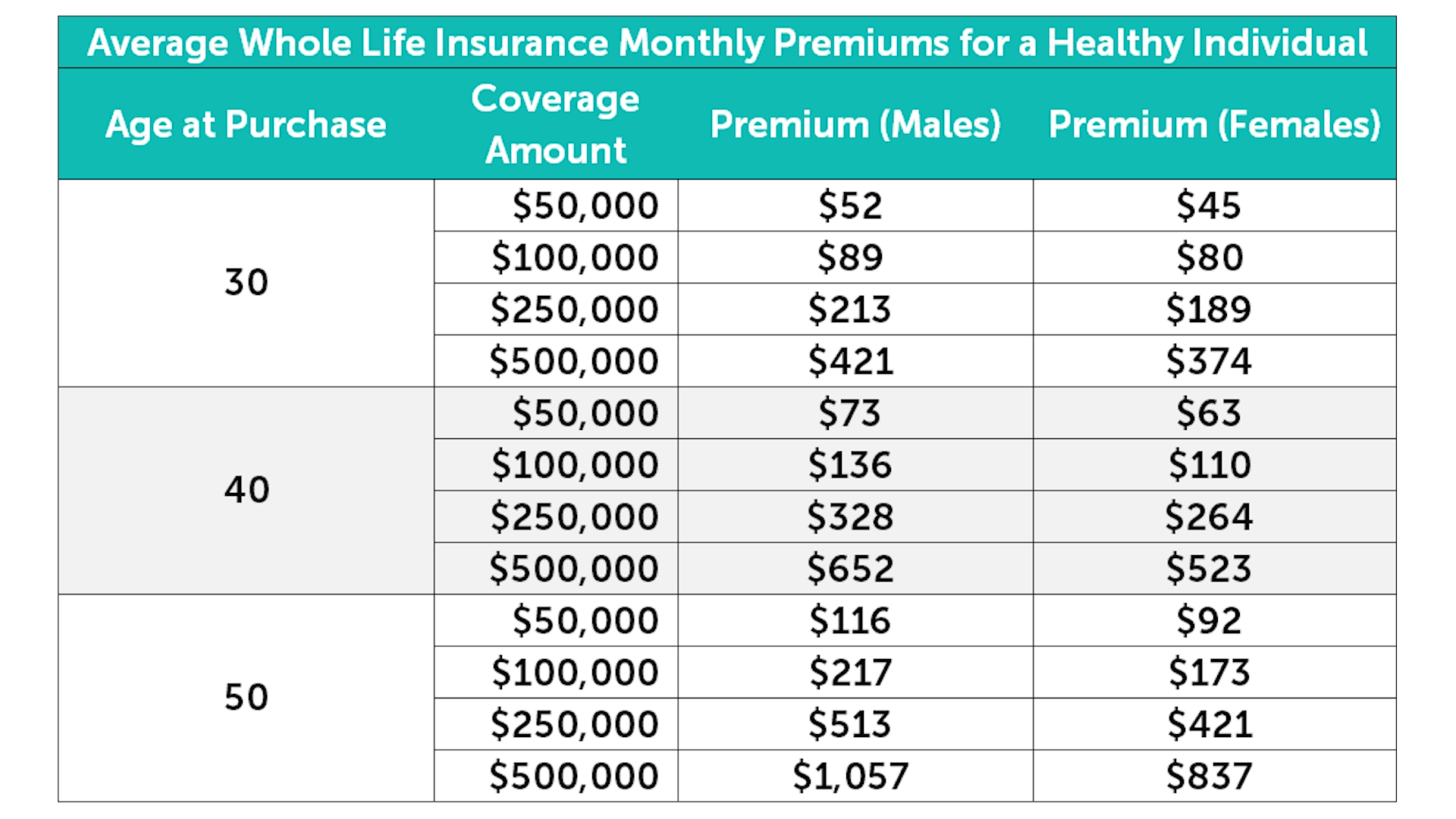

The rates displayed below are. How much does permanent life cost.

The Millennial S Introductory Guide To Term Life Insurance

The Millennial S Introductory Guide To Term Life Insurance

Please be aware that the quotes are for informational purposes only and do not reflect what whole life insurance costs.

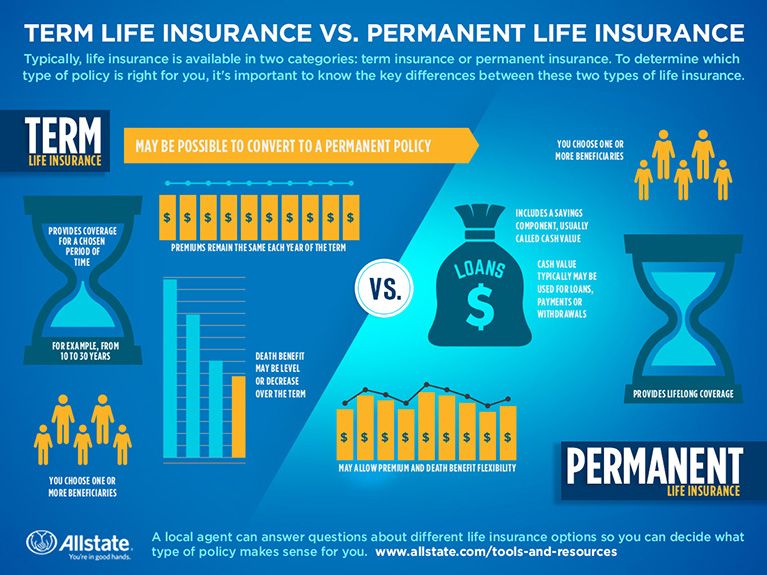

Permanent life insurance cost. Whole life policies are available to applicants up to age 85 with. According to Policygenius quoting data in January 2021 permanent life insurance policies such as whole life typically cost five to 15 times more than term life insurance for the same death benefit amount. Permanent life insurance cost The cost of permanent life insurance can vary significantly among policy types.

A guaranteed universal life insurance policy might be four times the cost of a term policy with similar coverage while a whole life policy could easily be 10 times the cost. Most permanent life insurance policies give you the option of choosing how long you want to. Average Cost of Whole Life Insurance In this section weve compared the monthly cost of a 50000 whole life policy to a 50000 guaranteed universal life policy.

Permanent life insurance is an umbrella term for life insurance policies that do not expire. 2 With universal life insurance youll have. Permanent Life Insurance Cost Mar 2021.

When it comes to permanent life insurance costs or any insurance for that matter its important to remember there are different variables that determine your premiums. Whole life insurance is a permanent. Of course this cost varies significantly depending on which end of those ages you are your lifestyle and your overall health.

You should think of this number strictly as a baseline - your own rates for life insurance will change depending on your age the insurer you choose and the amount of coverage that you find is right for your family. Term life insurance policies are issued up to age 80 and can be renewed yearly until age 94 with coverage starting at 100000. Average term life insurance rates by age.

Both insurance policies offer level rates and fixed coverage until the age of 100 or later. The average cost of life insurance is 26 a month. This is based on data provided by Quotacy for a 40-year-old buying a.

Typically permanent life insurance combines a death benefit with a savings portion. For example if you have 200000 in permanent life and 300000 in term for 20 years at the end of 20 years the term life insurance policy goes away but you still have your 200000 permanent. You have children or grandchildren.

How much does permanent life insurance cost. For a healthy person between the ages of 25 and 40 a 250000 policy that lasts 20 years will only cost on average around 16 a month. The whole life insurance rates by age charts below are examples of what you can expect to pay for a typical policy.

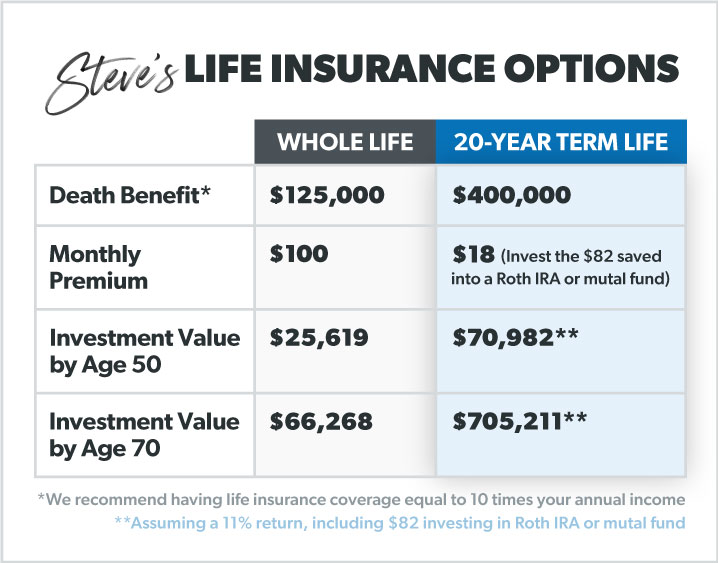

Here are sample rates for whole life and universal life policies compared to term life. A 2015 study by Consumer Reports found that the average rate of return for permanent life insurance was between 2 and 3 a year realistic and sustainable numbers. Permanent life insurance tends to be more expensive than term life insurance oftentimes costing 10 times more.

Schedule a call with one of our in-house insurance brokers so you can help you find the best whole life insurance quotes from leading Canadian insurance companies. That being said one of the greatest benefits of permanent insurance includes its lifelong coverage. The average cost of a life insurance policy is between 40 and 55 per month but costs vary based on insurance type and your health history.

A financial advisor can help you decide whether a life insurance policy could help you reach your investment goals. Cash value with downside protection Lower your risk by building cash value with downside protection. The biggest variable to know is age.

Weve found that the average cost of life insurance is about 126 per month based on a term life insurance policy lasting 20 years and providing a death benefit of 500000. Two of the most common types of permanent life insurance include whole life insurance and universal life insurance. Permanent Life Insurance Costs Explained.

Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity. As the best online life insurance brokerage in Canada we have access to permanent life insurance quotes from the best life insurance companies in Canada. For a 500000 policy the average premium.

Enjoy paying the same amount over time starting at 13668mo for 100000 of Whole Life Advantage for life. Yep when it comes to life insurance age matters. Whole Life Insurance Rates Comparison.

Life insurance policies vary depending on your health age type of policy and coverage amount. How Much Is Permanent Life Insurance Going to Cost. Heres a sample premium comparison chart from AAA of Southern California.

How much is life insurance.

The Differences Between Term And Permanent Life Insurance Quotacy

The Differences Between Term And Permanent Life Insurance Quotacy

Quotes For Life Insurance Policies Master Trick

Permanent Life Insurance Options Forbes Advisor

Permanent Life Insurance Options Forbes Advisor

Term Life Vs Whole Life Insurance Understanding The Difference Clark Howard

Term Life Vs Whole Life Insurance Understanding The Difference Clark Howard

What Is Term Life Insurance Ramseysolutions Com

What Is Term Life Insurance Ramseysolutions Com

Permanent Life Insurance 101 What You Need To Know Allstate

Permanent Life Insurance 101 What You Need To Know Allstate

Convert Term Life Into Permanent Life Insurance To Keep Your Rate Class

Convert Term Life Into Permanent Life Insurance To Keep Your Rate Class

Life Insurance Rate Chart By Age Term Life Insurance Quotes Life Insurance Quotes Term Life

Life Insurance Rate Chart By Age Term Life Insurance Quotes Life Insurance Quotes Term Life

Whole Life Insurance Premium Chart Ganabi

Average Life Insurance Rates For 2021 Policygenius

Average Life Insurance Rates For 2021 Policygenius

Life Insurance Over 70 How To Find The Right Coverage

Life Insurance Over 70 How To Find The Right Coverage

Whole Life Insurance Rates By Age Chart

Whole Life Insurance Rates By Age Chart

Average Life Insurance Rates For 2021 Policygenius

Average Life Insurance Rates For 2021 Policygenius

Whole Life Insurance Premium Chart Ganabi

Whole Life Insurance Premium Chart Ganabi

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.