During the year in. Can I collect Social Security at 62 and still work.

Social Security At 62 Fidelity

Social Security At 62 Fidelity

You can get Social Security retirement benefits and work at the same time.

/social-security-retirement-benefits-while-working-2894597-v1-1cd7c45096a24f059e87116a5c8e6326.png)

Can you collect social security at 62 and still work. Suppose you reach full retirement age this year. However if you are younger than full retirement age and make more than the yearly earnings limit we will reduce your benefit. You can take Social Security retirement as early as age 62.

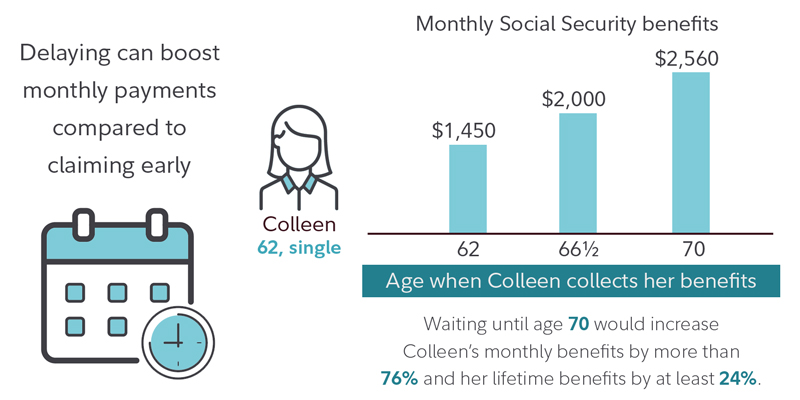

If you have a part-time job that pays 25000 a year 6040 over the limit Social Security will deduct 3020 in benefits. If you take Social Security retirement prior to your full retirement age you incur penalties for your earned income if you earn in excess of 14160. After age 62 your benefit will increase each year that you delay taking benefits until you reach age 70.

Q if I retire at 62 will I still be able to work part time. In that case the earnings limit is 50250 with 1 in benefits withheld for every 3 earned over the limit. A According to Social Security Administration.

To claim Social Security spousal benefits youll need to meet certain criteria including being at least age 62 in most cases. You can also continue to work. Todays column addresses questions about the Social Security earnings test when spousal benefits can be available potential costs of filing early at 62 public pensions and the Windfall.

The penalty for every 2 you earn in excess of 14160 is 1. You can get Social Security retirement or survivors benefits and work at the same time. But if you earn more than a certain amount from your workand havent reached your.

In the year in which you will reach full retirement age the cap goes up and when you pass the milestone birthday it disappears. You can work while you receive Social Security retirement or survivors benefits. Yes you can c.

What is the best age social security to retire. Yes but collecting Social Security early probably isnt the best option if you earn very much. In the years before you reach full retirement age currently 66 and 2 months and gradually rising to 67 you are subject to Social Securitys earnings test which reduces your benefits if your income from work exceeds a set limit 18960 in 2021.

You can collect Social Security benefits if you are still working and earning income. Your social security retirement age has an impact on your social security retirement benefits. If youre below your full retirement age but are 62 years or older you can work and receive Social Security benefits at the same time.

If youre eligible for Social Security you can start collecting your benefits as early as age 62. Your spouse or ex-spouse also must be living. Social Security claimants who will hit their full retirement age at some point during the current year are allowed to earn up to 48600 4050 a month in 2020 before any sort of withholding.

If you file for benefits between now and the year before your turn 66 the agency will withhold 1 in benefits for every 2 of earnings in excess of the lower exempt amount. Delaying Benefits Increases Payout You can begin collecting reduced benefits as early as age 62. But unless youve reached your full or normal retirement age.

If you are younger than full retirement age and earn more than the yearly earnings limit we may reduce your benefit amount. However there is a limit to how much you can earn and still receive full benefits. Benefits will not decrease if you stop working at age 62 and defer taking benefits.

Social Security withholds your monthly checks to cover the penalty. Keep in mind that the criteria for spousal benefits varies depending on whether youre married or divorced. When you do it could mean a higher benefit for you in the future.

Starting with the month you reach full retirement age we will not reduce your benefits no matter how much you earn. If you achieved full retirement age in 2021 you could have earned up to 18240 in 2020 and still received your.